Automation Anywhere's Moves Indicate Possible IPO in the Future

Although there hasn’t been any official word about an Automation Anywhere IPO, the company has appointed some top executives who have experience in the process.

July 7 2021, Published 12:07 p.m. ET

Automation Anywhere, a robotic process automation (RPA) software company, is making the moves toward going public through an IPO. Although there hasn’t been any official word about an Automation Anywhere IPO, the company has appointed some top executives who have experience in the process.

In May, the company announced the appointment of James Budge as the CFO and Mike Micucci as the COO.

Budge helped prepare three companies to go public through the IPO process. Before joining Automation Anywhere, he spent over four years as the CFO at Pluralsight where he led that company through its IPO in 2018.

In his role as CFO at Automation Anywhere, one of Budge’s top priorities will be to ensure that the company has the business processes and infrastructure necessary to become a public company, the company said in a statement.

Micucci spent 11 years at Salesforce, most recently as the CEO of Salesforce Commerce Cloud and Community Cloud. During Micucci’s time at Salesforce, Automation Anywhere received $290 million in a Series B funding round led by Salesforce Ventures, the investment arm of Salesforce. After that funding round, the company was valued at about $6.8 billion.

“With these seasoned industry veterans on board, we are more prepared than ever to bring the benefits of cloud RPA and intelligent automation to every organization that wants to liberate its employees from manual, repetitive tasks, and free them to be more productive,” said Mihir Shukla, the CEO and co-founder of Automation Anywhere, in a statement. “I’m thrilled to welcome both of these world-class executives as we build on market momentum and head towards our next phase of growth.”

What is Automation Anywhere?

Founded in 2003, Automation Anywhere is a global leader in RPA software. RPA software uses “bots” to automate digital tasks similar to the way humans do but faster and more productive.

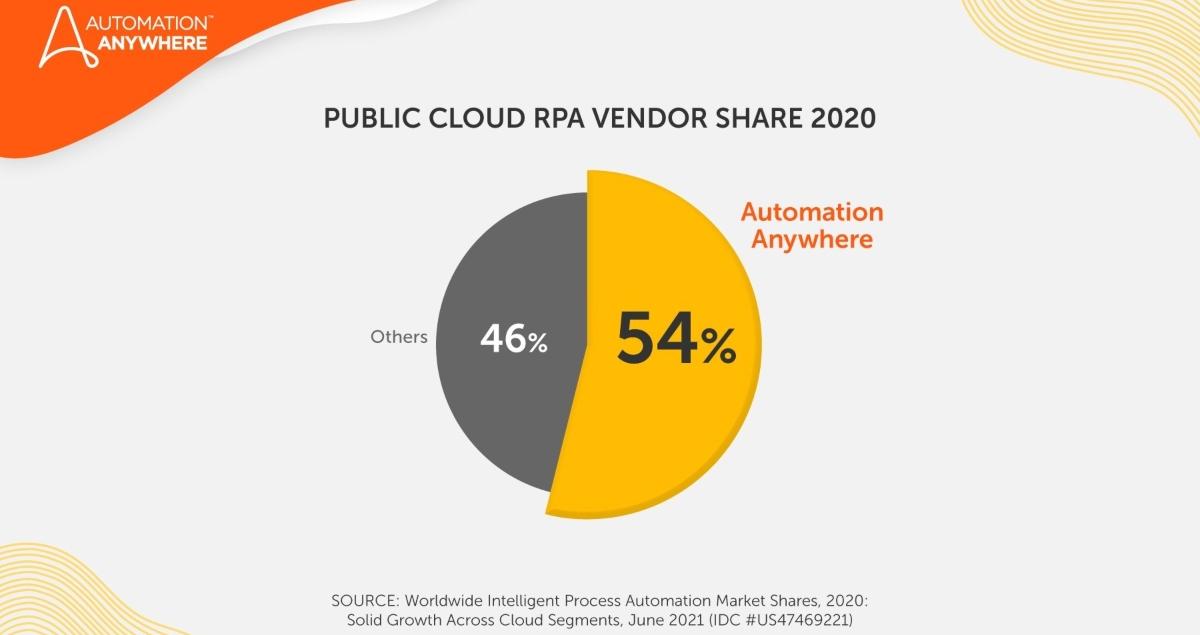

Earlier this month, Automation Anywhere announced it has a 54 percent share of the RPA market. It's the world’s top public cloud RPA platform. The company has deployed nearly 3 million bots supporting the company across all industries in over 90 countries.

“This dominant market share position demonstrates that customers see significantly more value in Automation 360, the first cloud-native RPA platform in the market today, compared with ‘on prem solutions’ hosted in the cloud from its competitors,” the company said in a statement.

Is Automation Anywhere a good investment?

The success of other software company IPOs might indicate whether Automation Anywhere would be a good investment when it does go public. The company’s top competitor, UiPath Inc. (PATH), went public in May in a $1.4 billion IPO. It was the third-largest software IPO ever in the U.S., right behind Snowflake at $3.9 billion and Qualtrics at $1.78 billion.

In the UniPath IPO, shares started selling at $56 and peaked at $79.73 before closing at $76.58. Almost 24 million shares were sold on that day.

UniPath shares have fallen a bit since opening. On July 7, PATH shares were trading at about $65.66.