Are NFTs a Good Investment? Maybe Not for the Average Investor

NFTs gained serious popularity in a short amount of time. Are they as good of an investment as digital art aficionados make them out to be?

June 29 2021, Published 2:58 p.m. ET

Like short squeezes and meme stocks, NFTs (non-fungible tokens) gained serious steam in the first half of 2021. Many people have found it difficult to understand the basis of digital art collection, especially in a world where JPEGs and GIFs are more accessible than illegally downloaded movies. However, people have managed to grasp the concept long enough for many NFTs to go for thousands or millions of dollars.

Are NFTs as good of an investment as they're made out to be? Are NFTs another chance for early activists to get rich while subsequent buyers lose their fortunes?

The value of an NFT is like any other collectible.

Many collectible items gain value over time (think sports memorabilia and high art). Others, like Beanie Babies, tank and leave long-time collectors in the dust.

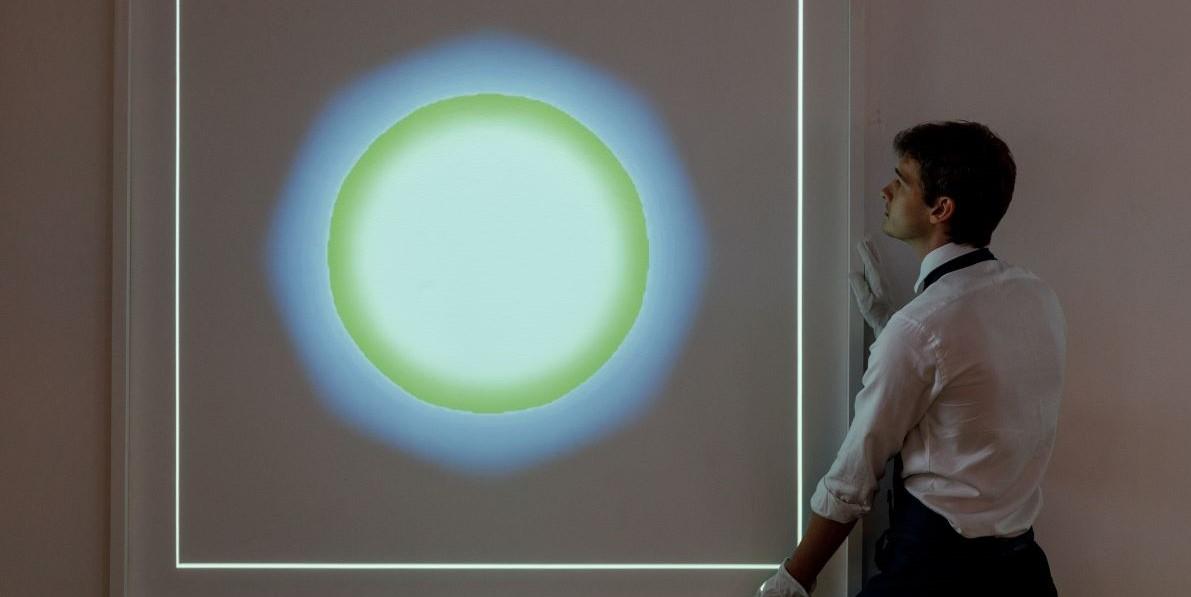

Collectibles of all kinds are worth what people are willing to pay for them. As a vehicle for digital art collection, NFTs have become known for wildly high valuations. For example, Krista Kim's Mars House sold for $500,000. Jack Dorsey sold his first tweet ("just setting up my twttr") as an NFT for $2.9 million.

A certain number of people have already acquired wealth in the NFT realm, but only some are liquidating that income. Kim noted that she plans to keep her NFT in the market because she expects it to gain value over time.

The potential in NFTs

NFTs represent the unknown, so they carry more risk than traditional investing (much like many of the thousands of altcoins that currently populate the market). Despite that, they do carry unique potential.

NFTs could work to buy and sell digital concert tickets or other useful assets. If the NFT value remains steady or grows, they can serve as the medium for buying, selling, and owning digital assets of any kind. It would take a lot of mainstream adoption for this to occur, but it's a possibility nonetheless.

At the moment, NFTs are rather scarce. That makes them more valuable, but it isn't clear whether scarcity will remain.

The risk in NFTs

The interest in NFTs came hard and fast. Seemingly all of a sudden, people were investing thousands or millions of dollars in a digital asset. The swiftness of the craze has many experts worried that NFTs as a whole can't maintain the momentum.

Like many ICOs (initial coin offerings), there's always the risk that the NFT market will tank and leave investors at a major loss. The reality is that some NFTs could prove futile (meaning the associated asset's value tanks) while others offer reputable opportunities for increasing wealth.

Most NFTs are standing on flimsy ground.

Since the value of a digital art NFT is rooted in sentiment (and practically nothing else), the risk is much higher than with other types of investments. NFTs associated with sports memorabilia might be more inclined to gain value, but it's possible collectors will be more likely to invest in tangible items than digital assets moving forward. Meanwhile, NFTs that reflect useful or physical items (like event tickets or land) could be more poised to profit in the long term.

Above all else, be careful with an NFT investment. Do your due diligence and only invest what you're willing to lose because nothing is guaranteed.