Are IPOs Dead and What Are the Hottest IPOs Expected in 2022?

Is the U.S. IPO market dead or will it rebound? Also, what major companies are expected to IPO in 2022? Here's what to expect from IPOs.

March 21 2022, Published 8:27 a.m. ET

The last two years have been phenomenal for the U.S. IPO market. The IPO market rebounded sharply from the first quarter of 2020 lows and the good run continued in 2021. However, the market has been silent in 2022 and there hasn’t been any major listing so far. Is the U.S. IPO market dead or will it rebound? Also, what major companies are expected to IPO in 2022?

While the U.S. IPO market was strong in 2021 and made a record in terms of new listings as well as the total amount of money raised, there's a depressing data point. Most companies that went public in 2021 trade below the IPO price.

IPOs haven't performed well.

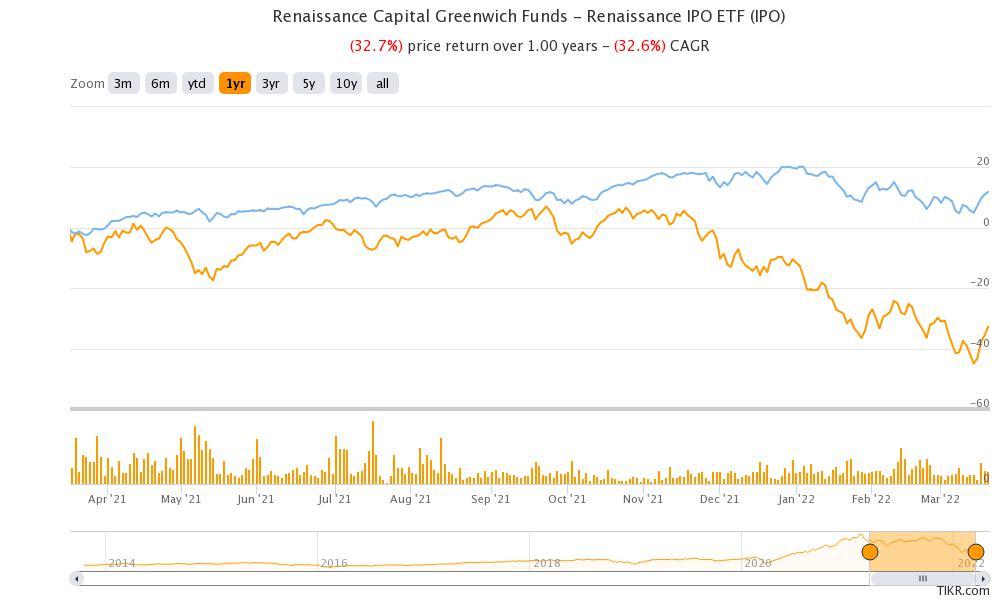

The price action of the Renaissance IPO ETF, which invests in newly listed companies, is a testimony to the carnage in IPOs. The ETF is down 24 percent YTD in 2022 and has lost almost a third over the last year. The ETF has underperformed the S&P 500 over the last year after the 2020 outperformance.

The dismal price action of IPOs, including the hyped names like Rivian and Robinhood, both of which trade well below the IPO price, has dampened the market sentiments.

What’s wrong with the U.S. IPO market?

First, we should understand the excesses in the U.S. primary market, which coincides with the bubble in SPACs. Companies were seeking humongous valuations in the IPO, which left little on the table for investors. Almost all the companies that have gone public since 2020 are loss-making growth companies.

Once it became clear that the U.S. Federal Reserve is on track to raise interest rates, growth stocks came under pressure. Their valuations started to appear even uglier amid higher bond yields. While markets were comfortable with high double-digit price-to-sales multiples a year back, now investors are questioning the business models and profitability outlook for growth companies.

To make things worse, recently listed companies have faced multiple idiosyncratic issues including production bottlenecks, growth slowdown, and an increase in losses. The recent sell-off in the broader market and the pivot towards fundamentally strong and profitable companies haven't helped matters for IPOs.

Is the U.S. IPO market dead?

The U.S. IPO market has been virtually dead for the last three months. To revive the market, a few things are needed. First, market sentiments towards growth stocks need to improve significantly.

Second, companies looking to go public would have to be sanguine about the kind of valuations that they seek. The 2025 and 2030 stories that a lot of companies, especially those that went public through a SPAC reverse merger sold, are no longer sellable.

There's still an appetite for companies that are either profitable or have a clear (and believable) path to profitability. A lot of companies that went public through SPAC mergers over the last two years provided a rosy forecast which didn't look realistic from the onset.

What are the most awaited IPOs of 2022?

Several companies are expected to IPO in 2022. The companies include Reddit, which has already confidentially filed for an IPO. A lot of fintech companies, including SoFi, have listed over the last two years. In 2022, Stripe, Klarna, and Chime are the three fintech companies that might consider a listing.

Discord is also expected to list in 2022. The company was previously in talks with Microsoft for an acquisition. Discord was also rumored to go public through a reverse merger with Chamath Palihapitiya’s Social Capital Hedosophia Holdings VI (IPOF).