Here’s Everything We Know About Adam Neumann’s Flow

Adam Neumann has founded a new company called Flow which has attracted investment from Venture capital firm Andreessen Horowitz. Learn all about the real estate company,

Aug. 16 2022, Published 8:11 a.m. ET

WeWor founder Adam Neumann has founded a new company called Flow, which has attracted investment from venture capital firm Andreessen Horowitz. Neumann had an unceremonious exit from WeWork after the failed IPO in 2019. Here’s what we know (or don’t know) about Flow.

WeWork eventually went public in 2021 through a SPAC reverse merger. However, as is the case with most other de-SPACs, WeWork, which now trades under the ticker symbol “WE,” trades well below the SPAC IPO price of $10.

A quick recap of the Adam Neumann WeWork controversy:

WeWork was looking at a valuation of over $45 billion in the 2019 IPO. However, the IPO did not go through for multiple reasons, including massive losses and Neumann's conflicts of interest. Eventually, SoftBank jumped in to pour more cash into the struggling business. In 2021, WeWork merged with BowX Acquisition SPAC at an enterprise value of $9 billion. Its market cap has since plunged to $4 billion.

Adam Neumann has now launched Flow real estate.

The website for Adam Neumann's new company, Flow, does not provide much information. However, a New York Times report called it “effectively a service that landlords can team up with for their properties, somewhat similar to the way an owner of a hotel might contract with a branded hotel chain to operate the property.”

Andreessen Horowitz has invested $350 million in Flow.

Andreessen Horowitz has invested $350 million in Flow at a valuation of $1 billion. A Andreessen Horowitz blog post about the investment is all praise for Neumann and Flow, though it does not include financial details.

The venture capital fund calls Neumann “a visionary leader who revolutionized the second largest asset class in the world — commercial real estate — by bringing community and brand to an industry in which neither existed before. Adam, and the story of WeWork, have been exhaustively chronicled, analyzed, and fictionalized — sometimes accurately."

Flow appears to be a residential housing venture.

Looking at Andreessen Horowitz’s blogpost, Flow seems to be a residential real estate venture. The post calls out problems associated with owning a house, such as high cost, multi-year mortgages, and being stuck with one place, which can mean missing out on other economic opportunities.

It calls renting a home “a soulless experience” and rightly points out that tenants do not own the properties where they reside, even after paying rent for decades. Andreessen Horowitz believes Neumann’s Flow is the answer to what it calls a “housing crisis” in the U.S.

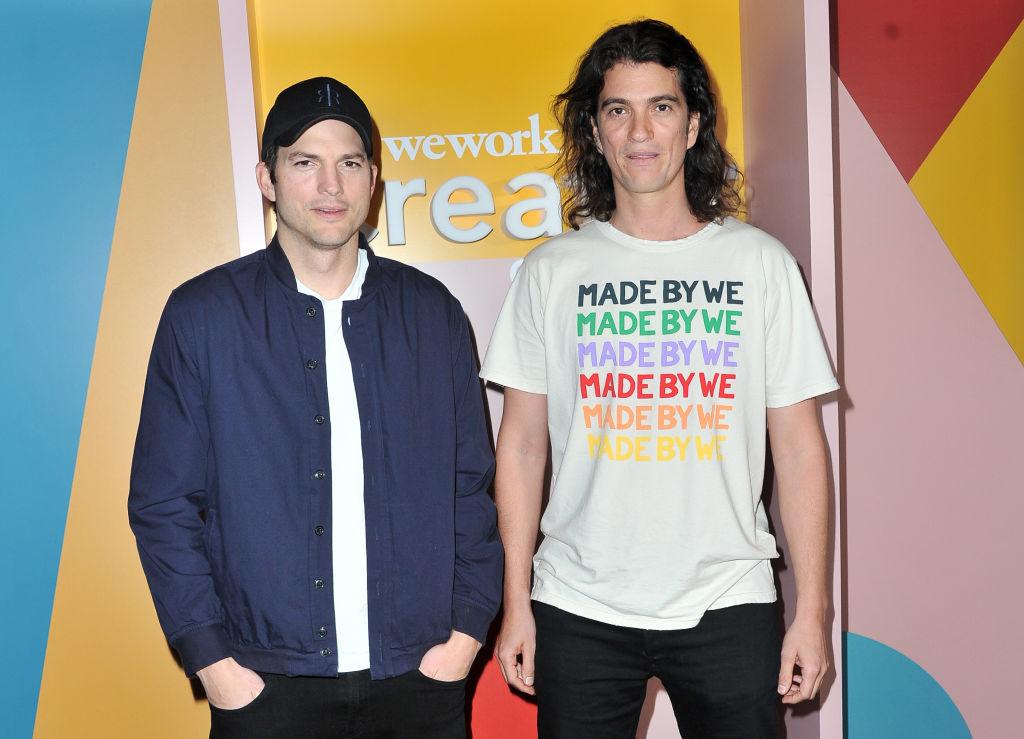

Adam Neumann, right, pictured with actor and WeWork investor Ashton Kutcher.

It added, “We think it is natural that for his first venture since WeWork, Adam returns to the theme of connecting people through transforming their physical spaces and building communities where people spend the most time: their homes.”

The U.S. appears to be in a housing recession.

Meanwhile, the report of Andreessen Horowitz’s investment in Flow comes at a time when the U.S. housing market is staring at a slowdown. The National Association of Home Builders/Wells Fargo Housing Market Index has fallen to 49 and readings below 50 signal negative sentiments.

The index has been falling for eight straight months. After the six-point fall in August, it is now below 50, which is technically a “housing recession.” The slowdown in the housing market has been visible for months now and the market has been gradually transitioning to a “buyers’ market” as sellers in many sellers have lowered prices to sell their homes.