Michael Burry Buys GEO Group Stock, Dumps Other Holdings in Q2

Scion Asset Management's second-quarter 13F revealed that Michael Burry sold the existing holdings and added GEO Group stock in the quarter.

Aug. 16 2022, Published 8:14 a.m. ET

We are in the 13F filing season and Scion Asset Management has released its 13F for the second quarter of 2022. The fund is led by Michael Burry who rose to fame by correctly predicting the U.S. housing market crash in 2008. The second-quarter 13F revealed that Burry sold the existing holdings and added GEO Group stock in the quarter.

Burry bet against CDOs featured in the best-selling book "The Big Short: Inside the Doomsday Machine" and the film adaptation The Big Short. Burry is among the most followed asset managers and often makes bold predictions — not all of which come true.

Burry sold all the holdings in the second quarter.

Scion Asset Management held stocks worth $165 million at the end of the first quarter. The fund also held put positions on Apple stock. Burry often takes short positions in stocks that he believes are overvalued. Over the last few years, Tesla and the ARK Innovation ETF (NYSE: ARKK) have been among Burry’s short positions.

While Tesla stock continued to soar after Burry’s short position, ARKK tumbled amid the crash in growth stocks. ARKK is managed by Cathie Wood and most of the ETF's holdings have plummeted. Wood is among the most notable Tesla bulls. The Elon Musk-run EV (electric vehicle) company forms part of several ARK ETFs and is the biggest holding for ARKK, the flagship fund.

Which stocks did Burry sell in the second quarter?

In the second quarter of 2022, Burry sold several stocks including Cigna, Alphabet, Meta Platforms, Bristol Myers Squib, and Booking Holdings. His followers see the selling as a sign that Burry sees a market crash.

Burry recently tweeted "can't shake that silly pre-Enron, pre-9/11, pre-WorldCom feeling.” He has been warning of a market crash for quite some time now. Burry frequently deletes his tweets and also banned his profile for new users in 2021.

So far in 2022, Burry has warned of a crash on more than one occasion. In May, in a now-deleted tweet, he said that stock markets are like watching a plane crashing, similar to 2008. On June 30, Burry tweeted that the stock market crash is halfway and said that while multiples have contracted, earnings estimates would fall next.

Burry bought GEO Group stock.

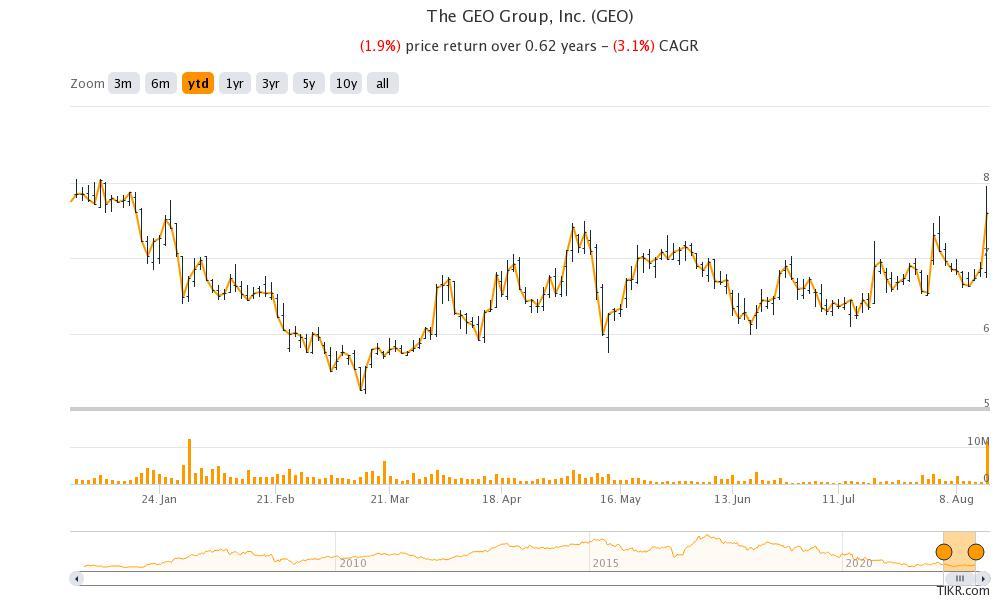

While Burry sold off all the 12 stocks that the fund was holding, he added GEO Group stock. The company is the world’s second-largest prison company and operates as a REIT. The company has a market cap of just under $1 billion and rose over 10 percent on Aug. 15 after Scion Asset’s 13F was released.

Wall Street analysts are also bullish on GEO stock.

Wall Street analysts are also bullish on GEO stock and it has one "buy" and one "hold" rating from analysts. Its median target price of $15 is an upside of almost 100 percent from these levels.

GEO stock is down just about 2 percent for the year and is outperforming the markets. However, Burry has taken a small stake in the company valued at around $3 million, which is only a fraction of Scion Asset’s total assets at the end of the first quarter of 2022.