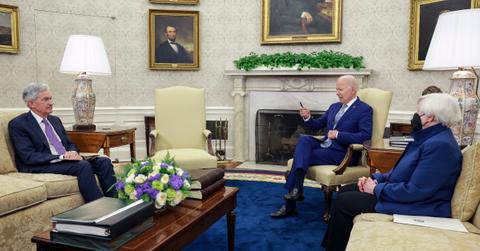

Biden's Policies Are Making the Fed’s Fight Against Inflation Even Tougher

Biden is pursuing an expansive fiscal policy while the Fed is tightening. His policies could be making the Fed's job of taming inflation even tougher.

Aug. 30 2022, Published 8:36 a.m. ET

High inflation in the U.S. has been a concern for both the Federal Reserve as well as the Biden administration. However, while the Fed has embarked on the most aggressive tightening in decades, the Biden administration continues to pursue accommodative fiscal policies, even if not to the scale that we saw in 2021.

In 2020, when the Fed was on a historical easing spree, it called upon the federal government to “unleash the great fiscal power” to support the economy. Both the Trump and Biden administrations opened up the state coffers at a scale that we haven't seen, at least in recent memory. While the policies of the Fed and the Federal government were aligned in 2020 and 2021, we see a divergence in 2022. Could Biden’s policies be making the Fed’s fight against inflation even tougher?

U.S. inflation fell in July.

After surpassing 9 percent in June, U.S. inflation fell to 8.5 percent in July. While a month’s fall in inflation made many believe that the Fed would soon pivot from rate hikes to rate cuts, Fed Chair Jerome Powell dashed those hopes at the Jackson Hole Symposium.

Powell made it clear in no uncertain terms that the time isn't ripe to pivot from rate hikes. He also said that the U.S. Central Bank will continue to raise rates even as it will bring pain for both consumers and businesses.

While Powell’s speech at Jackson Hole got all the attention, a paper released at the Symposium argued that unless the Federal government’s spending comes down, the Fed’s rate hikes won't be successful in taming inflation. The paper said, “The conquest of post-pandemic inflation requires mutually consistent monetary and fiscal policies to avoid fiscal stagflation.”

The paper added, "When the fiscal authority is not perceived as fully responsible for covering the existing fiscal imbalances, the private sector expects that inflation will rise to ensure sustainability of national debt.”

U.S. national debt has ballooned.

U.S. national debt has ballooned over the last two years and is now almost 125 percent of the GDP. While the incremental debt should come down in 2022, the fiscal policy is still expansionary. After committing massive money towards infrastructure, Biden has now announced the cancelation of student loans, which would come with a heavy cost to the exchequer.

The moratorium on student loan repayments has also been extended “for the last time.” The student loan cancelation would have an inflationary impact at a time when the Fed is looking to curb the aggregate demand in the economy. For the Fed’s monetary policy to have the desired results, it needs to be in sync with the fiscal policy.

U.S. Fed and Federal government are pursuing different policies.

This was precisely the case in 2020 when both the Fed and the Federal government took unprecedented steps to bail out the economy. Now, with the pandemic slump giving way to multi-decade high inflation, the policies need to be realigned yet again, which isn't the case.

Faced with a tough midterm election amid Biden’s low popularity (for which inflation played a big role), the Democrats finally got Biden to cancel student loans. Loan cancelations are invariably a bad idea but Biden has few options as he had promised to do so during his campaign.

The divergence between Fed and the Federal government’s policy is only making the goal of lowering inflation tougher. While political compulsions drive the need for continued stimulus, no economy can be on such steroids for long without long-term consequences.