Apple’s Goldman Sachs Savings Account Is Coming — How It Will Work

Apple Card holders will soon get access to a Goldman Sachs savings account, but some details are still on the downlow. Here's what we know.

Oct. 14 2022, Published 11:27 a.m. ET

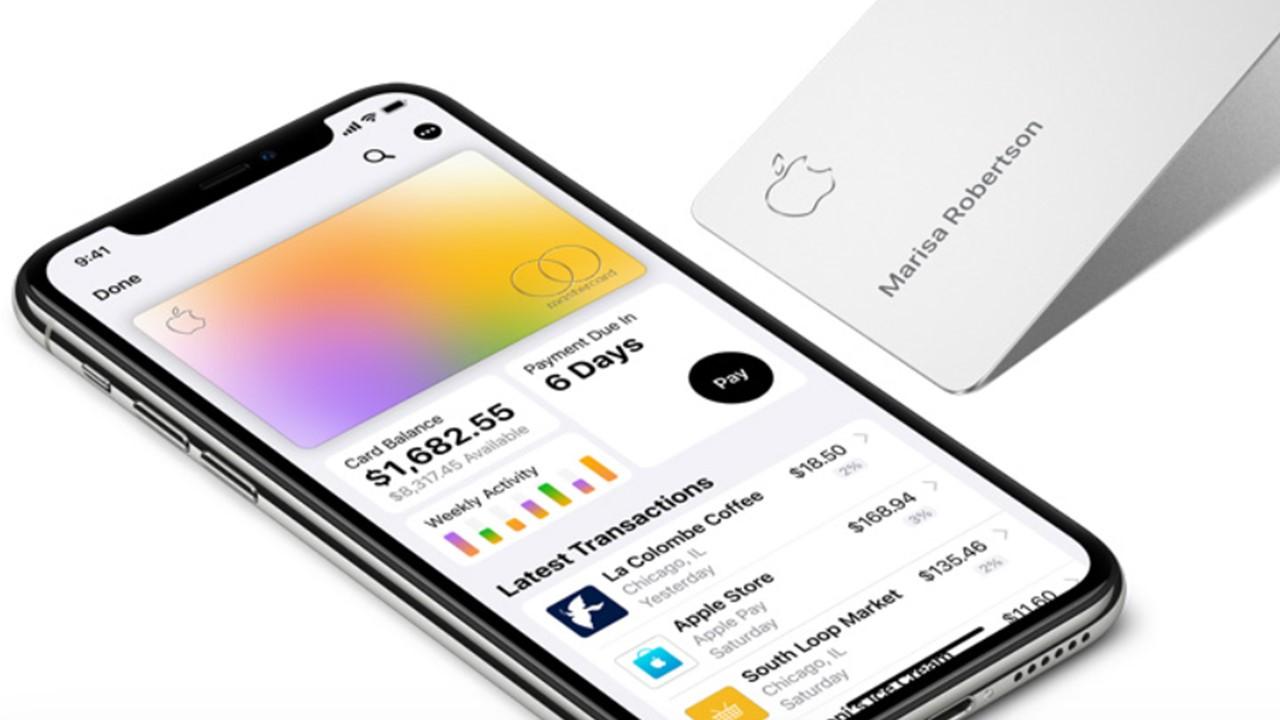

More than three years after Apple launched the physical Apple Card, the service continues to thrive, boasting at least 6.7 million users in the U.S. Now, Apple is expanding its partnership with Goldman Sachs by launching a forthcoming savings account.

Apple Card holders will be able to access the savings account in the future, but a lot of details remain up in the air. As for how it’ll work, here’s what we know so far.

Apple Card users are poised to gain access to a Goldman Sachs savings account.

Apple partnered with Goldman Sachs to launch the Apple Card, and its success has led to an expanded venture: a savings account just for Apple Card users.

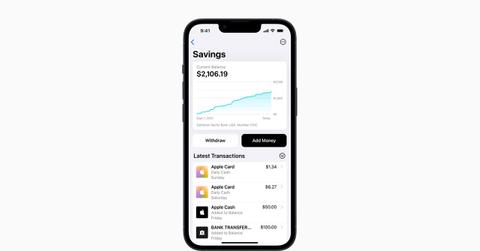

The account will be a part of Apple Wallet, enhancing the banking experience within the Apple ecosystem. Apple wrote in a press release that the account has “no fees, no minimum deposits, and no minimum balance requirements.”

Apple says users can deposit Daily Cash rewards into savings.

For its savings account, Apple will integrate an existing Apple Card feature called Daily Cash.

Daily Cash is a rewards system that grants users 3 percent back on Apple Card purchases that consumers use in Apple Pay, but only for purchases with Apple and select merchants (including Uber, Uber Eats, Walgreens, Nike, Panera Bread, T-Mobile, ExxonMobil, and Ace Hardware). Users can also get 2 percent Daily Cash when they use Apple Pay at other merchants, and 1 percent on all other purchases using the Apple Card.

The savings account will offer a feature that lets you automatically deposit your Daily Cash into your savings, where it can grow more thanks to the account’s interest-bearing features.

Apple adds, “Once users set up their Savings account, all future Daily Cash received will be automatically deposited into it, or they can choose to continue to have it added to an Apple Cash card in Wallet. Users can change their Daily Cash destination at any time.” This means you can allocate Daily Cash for different purposes depending on your needs at hand. Users will also be able to save with deposits from external accounts.

What about interest? The Apple Card savings yield is still unclear.

Apple says it will offer a “high-yield savings account,” but hasn’t specified a particular interest rate yet. Typically, a high-yield savings account offers an annual percentage yield (APY) that’s well above the Federal Reserve interest rate. While rate hikes put pressure on borrowers, it can be good news for savers (recognizing that, yes, these two camps do overlap). High-yield savings accounts tend to follow Fed rate trends, so higher rates mean higher interest yields.

High-yield savings accounts generally offer APY of 20–50 times that of standard yields. It’s unclear how “generous” Apple will be with its savings account yield.

Will Apple’s savings account live up to the hype?

There’s a lot we still don’t know about the Apple and Goldman Sachs savings account. What we do know is that it could be a solid savings option for people who want a fully integrated banking experience with compounding returns in a high-interest economic environment.