Ivan Kading

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Ivan Kading

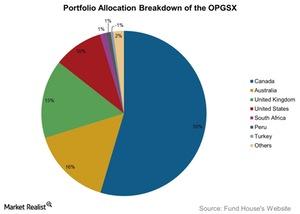

An Overview of OPGSX’s Precious Metal Holdings

OPGSX may also invest up to one-fifth of its portfolio directly into gold or silver bullion and other precious metals.

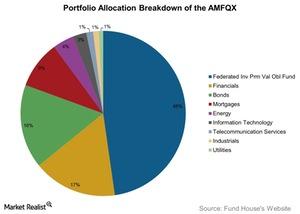

AMFQX: More Than 60% Exposure to Derivative Securities

AMFQX is an alternative mutual fund that seeks to generate positive absolute returns with a low correlation to the returns of broad stock and bond markets.

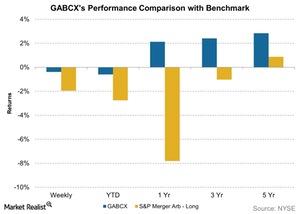

What Investors Should Know about the Alternative Mutual Fund GABCX

GABCX is an alternative mutual fund that seeks to achieve total returns that are attractive to investors in various market conditions without excessive risk of capital loss.

How Could Investing in EBSAX Affect Your Portfolio’s Performance?

EBSAX seeks to generate attractive risk-adjusted returns across a broad range of market conditions.

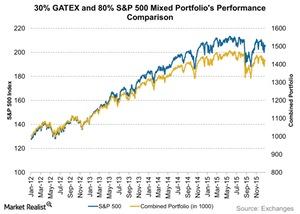

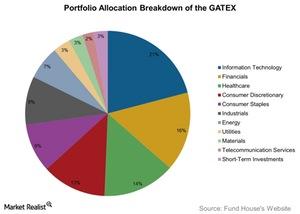

How Investing in GATEX Could Impact Your Portfolio

GATEX could increase the exposure of an investor’s portfolio in the equity market. It has less volatility risk than the equity markets.

GATEX: A Sectorial Portfolio Breakdown

The Gateway Fund – Class A (GATEX) seeks to attain capital appreciation through its equity market investments. It has less risk compared to equity markets.

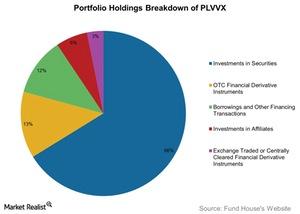

A Detailed Holdings Analysis of PLVVX

PLVVX holds fixed income securities in both long and short positions. The fund also holds derivative forward, future, and swap agreements on government securities, indexes, and currencies.

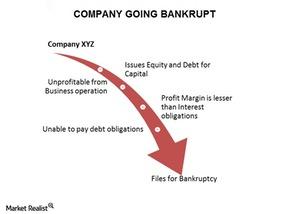

What Is Bankruptcy Investing?

Informed investors can profit from businesses that have filed for bankruptcy. A chapter 11 bankruptcy gives a company a second chance to revive its business.