Comparing Utility Stocks and Treasury Yields

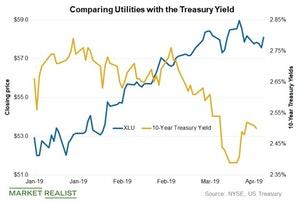

The benchmark ten-year Treasury yields closed at 2.5% last week. Treasury yields and utility stocks usually trade inversely to each other.

April 8 2019, Published 1:15 p.m. ET

Utilities versus Treasury yields

The benchmark ten-year Treasury yields closed at 2.5% last week. Treasury yields and utility stocks usually trade inversely to each other. The rate sensitive utilities sector has rallied almost 10% this year, while ten-year Treasury yield have fallen 7% during the same period.

The inverted yields scenario, which signals an upcoming recession, might have been overturned for now. The better-than-expected jobs report for March also painted a positive picture. The better jobs report might ease investors’ concerns and defer them to take shelter under defensives.

Utilities (XLU) normally carry large amounts of debt on their books. Higher interest rates increase utilities’ debt-servicing costs, which eventually hurts their profitability. The Fed has signaled no rate hikes in 2019, which will likely benefit utilities’ bottom line.

Utility stocks are usually seen as bond substitutes due to their steady dividend payments. Higher interest rates could make utilities less interesting compared to bonds. So, we usually see investors selling utility stocks (VPU) (IDU) and switching to bonds in order to obtain higher yields when the interest rates increase.