ExxonMobil: Analysts’ Recommendations

In the fourth quarter, ExxonMobil’s earnings rose and beat the estimates. ExxonMobil continued to take advantage of its integrated business model.

Feb. 4 2019, Updated 11:15 a.m. ET

Analysts’ recommendations

We started this series by examining ExxonMobil’s (XOM) segmental earnings in the fourth quarter. We discussed ExxonMobil’s stock performance after its earnings release on February 1. In this part, we’ll discuss analysts’ ratings for ExxonMobil after its earnings.

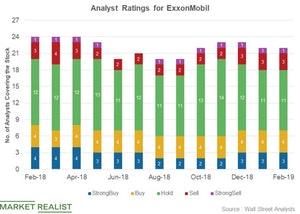

After ExxonMobil’s fourth-quarter earnings, it has been rated by 22 analysts. Among the analysts, seven (or 32%) have assigned a “buy” or “strong buy” rating, 11 (or 50%) have assigned a “hold” rating, and four (or 18%) have assigned a “sell” or “strong sell” rating on the stock. ExxonMobil’s mean target price of $83 per share is ~10% higher than its current stock price.

In the fourth quarter, ExxonMobil’s earnings rose and beat the estimates. ExxonMobil continued to take advantage of its integrated business model to raise the margin and earnings in its Downstream segment. The company continued to strengthen its upstream portfolio. Overall, ExxonMobil progressed well on its long-term growth path.

However, ExxonMobil stock continued to trade at a premium to peers’ averages. Likely due to ExxonMobil’s premium valuations, many analysts have assigned a “hold” or “sell” rating on the stock.

Peers’ ratings

BP (BP), Chevron (CVX), and Royal Dutch Shell (RDS.A) have been tagged as a “buy” by 54%, 78%, and 82% of the analysts, respectively. Total (TOT), Suncor Energy (SU), and Petrobras (PBR) have been evaluated as a “buy” by 100%, 92%, and 36% of the analysts, respectively.

Next, we’ll discuss the change in ExxonMobil’s implied volatility on February 1. We’ll also estimate ExxonMobil’s stock price range for the next seven days after its earnings.