Which Positions Did Einhorn Increase and Reduce in Q1?

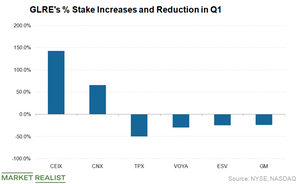

David Einhorn’s Greenlight Capital’s (GLRE) largest stake increase in percentage terms was in Consol Energy (CEIX), in which GLRE increased its stake by 142.9% in the first quarter.

Nov. 20 2020, Updated 4:43 p.m. ET

Stake increases

David Einhorn’s Greenlight Capital’s (GLRE) largest stake increase in percentage terms was in Consol Energy (CEIX), in which GLRE increased its stake by 142.9% in the first quarter. The fund also boosted its stake in CNX Resources (CNX) by 65.9% during the quarter. CNX Resources fell 11% after it reported weaker-than-expected Q1 earnings. Consol Energy is a pure-play coal stock.

Stake reductions

GLRE’s biggest stake reduction in percentage terms during Q1 was a 50% reduction in Tempur Sealy International (TPX), followed by a 30% reduction in Voya Financial (VOYA), 24.4% in Ensco (ESV), 23.7% in General Motors (GM), and 4.3% in Exela Technologies (XELA).

Portfolio holdings

Einhorn ventured into Ensco (ESV) in Q4 2017. At the time, he felt that after the oil price collapse of 2014, offshore exploration and development budgets were severely cut. This reduction would leave shale oil supply growth unable to fulfill demand, with the gap being filled by offshore drilling. GLRE has held Voya Financial since 2013.

Tempur Sealy is the world’s largest bedding provider. It develops, manufactures, and markets mattresses, foundations, pillows, and other products. TPX formed 2.7% of Greenlight Capital’s portfolio at the end of Q1.

Einhorn first established a stake in Exela Technologies (XELA) in Q3 2017. At the end of Q1, it formed 1.9% of the portfolio. Exela is a global business process automation company.