Tempur Sealy International Inc

Latest Tempur Sealy International Inc News and Updates

Who Were the Outliers in the Consumer Space on September 28?

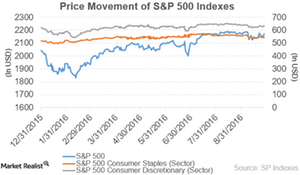

On September 28, the S&P 500 outperformed the S&P Consumer Discretionary and the S&P Consumer Staples, which saw returns of 0.53%, 0.30%, and 0.11%.

Newell Rubbermaid–Jarden Deal: Strategic Rationale

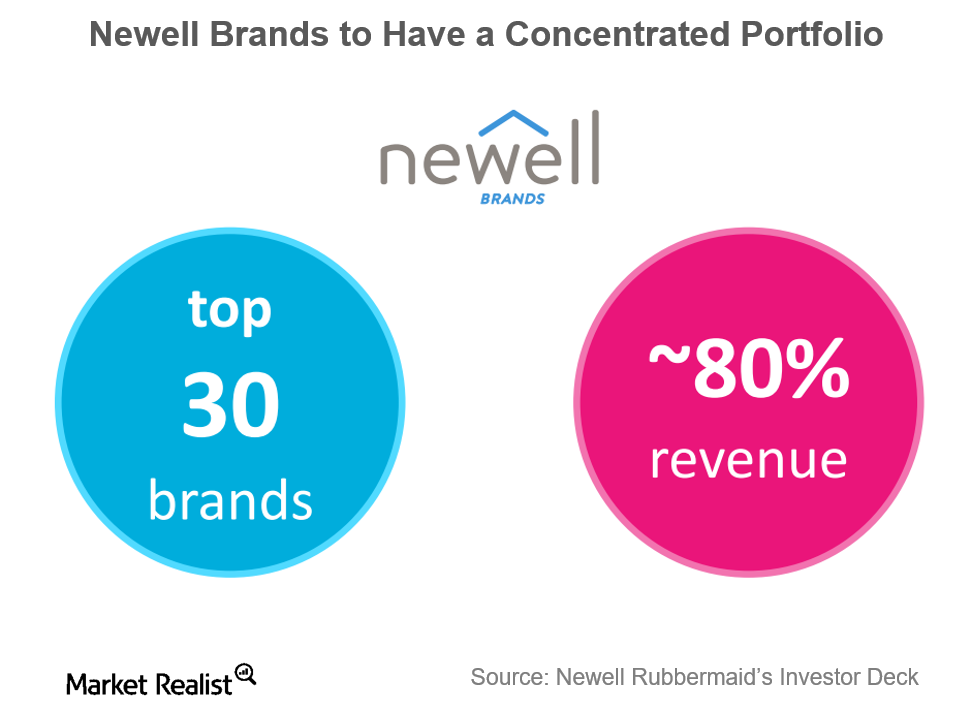

Strategic rationale of the deal Both Newell Rubbermaid (NWL) and Jarden (JAH) are US-based consumer products conglomerates operating in diverse industries, with presences in several global markets. Both companies have strong portfolios of leading brands that are number one or number two in their categories. The combined company will have a concentrated portfolio of brands, […]