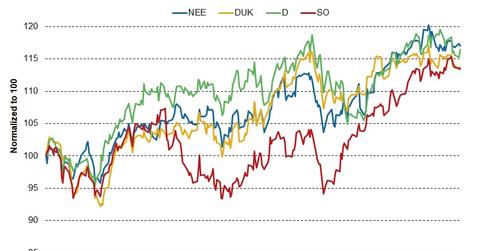

NEE, DUK, D, and SO: How Top Utility Stocks Are Currently Valued

NextEra Energy, the biggest utility by market cap, is trading at a forward PE multiple of 22x based on analysts’ estimated EPS for the next 12 months.

April 29 2019, Published 3:28 p.m. ET

Are top utilities expensive?

NextEra Energy (NEE), the biggest utility by market cap, is trading at a forward PE multiple of 22x based on analysts’ estimated EPS for the next 12 months. It seems to be trading at a large premium to its historical valuation and to its peers’ valuations.

NEE’s five-year historical average valuation is ~20x. In comparison, the peer average forward PE multiple is close to 18x. Among the top four biggest utility stocks, NextEra Energy’s earnings are expected to grow at a relatively high rate for the next few years.

To learn more about the top utilities’ (XLU) price targets, read Top Utilities’ Stock Price Targets Get Bumped Up.

Southern Company (SO) stock is trading at a forward PE of 17x based on analysts’ EPS estimates. SO appears to be trading at a discounted valuation to its historical valuation average of ~20x. Southern Company stock has rallied more than 20% so far this year and is trading close to an all-time high. Duke Energy (DUK), the top regulated utility stock, is trading at a PE multiple of 18x—lower than its five-year average.

Dominion Energy (D) stock also looks attractively valued. Right now, the stock is trading at a forward PE multiple of ~18.0x compared to its five-year historical average of 23x. The stock looks to be trading at a discount to its historical average valuation.

Dominion Energy will release its first-quarter earnings results this week. Its bigger peers NextEra Energy and American Electric Power have exceeded their consensus EPS estimates in the quarter. To learn more about Dominion Energy’s earnings, read What to Expect from Dominion Energy from Q1?