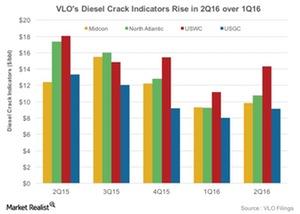

What Can We Expect from Valero’s Diesel Crack Indicators in 2Q16?

Valero’s diesel crack indicators have been rising in 2Q16 compared to 1Q16. The US West Coast, where VLO has 0.3 MMbpd refining capacity, saw the largest rise of $3.20 per barrel.

July 6 2016, Updated 10:05 a.m. ET

Valero’s diesel crack indicators

Valero’s (VLO) diesel crack indicators have been rising in 2Q16 compared to 1Q16. The US West Coast (or USWC), where VLO has 0.3 MMbpd (million barrels per day) refining capacity, saw the largest rise of $3.20 per barrel in its diesel crack over 1Q16, to $14.40 per barrel in 2Q16.

The US Gulf Coast (or USGC), which has 1.7 MMbpd of VLO’s refining capacity, witnessed a rise of $1 per barrel over 1Q16, to $9.10 per barrel in 2Q16.