PPL: Analysts’ Views and Target Prices

PPL (PPL) stock offers an attractive potential upside of more than 13% in a year with a mean target price of $32.3. PPL stock is trading at $28.5.

April 30 2018, Updated 9:01 a.m. ET

Analysts’ views and target prices

According to Wall Street analysts’ consensus, PPL (PPL) stock offers an attractive potential upside of more than 13% in a year with a mean target price of $32.3. Currently, PPL stock is trading at $28.5.

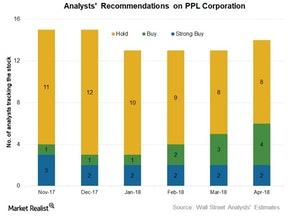

Among the 15 analysts tracking PPL, two analysts recommended the stock as a “strong buy,” four recommended it as a “buy,” eight recommended it as a “hold,” and one recommended it as a “sell” as of April 25.

Peers’ target prices

Xcel Energy (XEL) stock has a mean target price of $47.3 compared to its current market price of $45.7, which indicates a potential upside of 3.6% for the next 12 months.

SunTrust Robinson Humphrey raised Xcel Energy’s target price from $43.0 to $44.0 on April 23.

According to analysts’ consensus, Duke Energy (DUK), the second-largest utility by market capitalization in the country, has a mean target price of $81.9 compared to its current market price of $78.2, which indicates an estimated upside of ~5% in a year.

SunTrust Robinson Humphrey raised Duke Energy’s target price from $81.0 to $82.0 on April 23.

If you’re looking for S&P 500 Utilities (XLU) stocks with an attractive estimated upside, read These S&P 500 Utility Stocks Offer the Most Potential Upside.

For a comparison of the top utilities’ dividend profiles, read Analyzing the Biggest S&P 500 Utilities’ Dividend Profiles.