Is Freeport-McMoRan Worth a Look for Investors?

With the recent news of activist investor Carl Icahn taking an 8.5% stake in the company coupled with Freeport’s lower capital expenditure guidance, the stock has seen a smart up move.

Sept. 13 2015, Updated 12:26 p.m. ET

Freeport-McMoRan

Commodity stocks have been out of favor with investors for almost a year now. That should be no surprise given the way commodity prices have played out over this period. Aluminum and copper prices are testing their six-year lows while iron ore touched its ten-year low earlier this year.

But then, commodity stocks have never been for the faint-hearted. During upturns, commodity companies tend to outperform almost all other asset classes. Conversely, these companies bear the brunt of downturns when economic activity takes a hit.

What drives commodity companies?

For companies in the metals and mining space (XME), commodity prices are perhaps the biggest driver of their earnings. Commodity prices themselves depend on several macro factors. And, as has been the case for last decade or so, Chinese demand has been driving commodity prices.

With enough signals that Chinese economic activity is losing steam, companies including Rio Tinto (RIO), BHP Billiton (BHP), and Vale (VALE) are feeling the heat. These companies had put up massive capacity anticipating ever-growing Chinese demand.

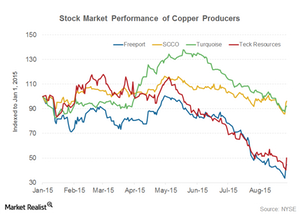

Then there’s Freeport-McMoRan (FCX), which has been affected by lower commodities as well as its large debt load. However, with the recent news of activist investor Carl Icahn taking an 8.5% stake in the company, coupled with Freeport’s lower capital expenditure guidance, the stock has risen. Nevertheless, Freeport is down ~60% since the beginning of 2015. The chart above shows the recent movement in Freeport’s share price.

Is this rise in Freeport’s share price only the proverbial “dead cat bounce,” or have investors finally discovered some value in the beleaguered company?

Freeport-McMoRan is predominantly a copper producer. Falling copper prices have been one of the reasons behind the slump in Freeport’s share price. We’ll explore Freeport’s outlook in this series. We’ll also explore the outlook for copper.

Let’s begin by looking at the recent trend in copper prices.