Novartis’s Innovative Medicines Segment in 2016

Novartis’s Innovative Medicines segment, formerly referred to as its Pharmaceuticals segment, consists of products for therapeutic areas including oncology, respiratory, and established medicines.

March 27 2017, Updated 9:08 a.m. ET

The Innovative Medicines segment

Novartis’s (NVS) Innovative Medicines segment, formerly referred to as its Pharmaceuticals segment, consists of products for therapeutic areas including oncology, cardio-metabolic, immunology and dermatology, retinal, respiratory, neuroscience, and established medicines.

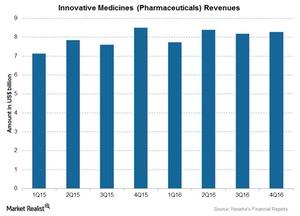

The overall contribution of the Innovative Medicines segment to NVS’s revenue was ~67% at $32.6 billion in 2016.

The Innovative Medicines segment includes two business units from Novartis: Novartis Pharmaceuticals and Novartis Oncology.

Key Innovative Medicines products

Growth products, including Gilenya, Tasigna, Galvus, a combination of Mekinist and Tafinlar, Promacta and Revolade, Jakavi, Entresto, and Cosentyx, drove a 20% rise in the segment’s revenue to $17.1 billion in 4Q16—nearly 35% of its total revenue.

Gilenya (fingolimod) is an oral therapy used for the treatment of multiple sclerosis. Due to increased demand, the therapy’s revenue rose 14% at a constant exchange rate to $3.1 billion in 2016, compared to $2.8 billion in 2015. Gilenya reported double-digit growth in most of markets. The therapy competes with Biogen’s (BIIB) Tecfidera (dimethyl fumarate) and Sanofi’s (SNY) Aubagio (teriflunomide).

Tasigna (nilotinib), a drug for the treatment of chronic myeloid leukemia, reported a 10% revenue rise at a constant exchange rate to $1.7 billion in 2016, following increased sales in both US markets and global markets. Tasigna competes with Pfizer’s (PFE) Bosulif (bosutinib).

A combination of Tafinlar (dabrafenib) and Mekinist (trametinib) is used in the treatment of BRAF V600+ metastatic melanoma. The combination has been approved in over 60 countries for the treatment of unresectable melanoma and in 35 countries for the treatment of metastatic melanoma. The combination reported a rise in revenue to $672 million in 2016, compared to $453 million in 2015.

To divest risk, investors can consider ETFs such as the PowerShares International Dividend Achievers ETF (PID), which holds 1.5% of its total assets in Novartis.