What Might Cap Rising Crude Oil Prices?

The US crude oil (USO) supply includes domestic production and imports. The supply gets consumed as inputs to refineries and exports.

Dec. 4 2020, Updated 10:52 a.m. ET

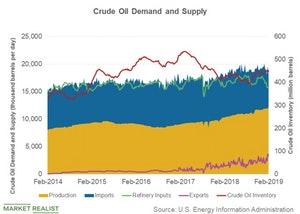

Crude oil demand and supply

Broadly, the US crude oil (USO) supply includes domestic production and imports. The supply gets consumed as inputs to refineries and exports. Over time, if the supply exceeds the demand, it results in a rise in the crude oil inventory—a bearish factor for oil prices.

The above graph shows how the various elements of crude oil demand and supply have trended over time. As the graph shows, rising oil production is finding its way to the exports market.

Another key point to note is that the crude oil inventory has fallen significantly from its high level in mid-2017. The inventory has risen in the last year and a half.

Excess production

Crude oil demand and supply dynamics are similar at the global level. According to the U.S. Energy Information Administration, despite “relatively lower supply from a number of major crude oil-producing countries, including Saudi Arabia, Libya, Venezuela, and Canada, global liquid fuels production was forecast to exceed global consumption through 2020.”

The excess production over consumption is expected to result in a rise in crude oil inventories. Higher production should keep oil prices capped, which we discussed in the previous part.

Stable oil prices are good for midstream stocks including Kinder Morgan (KMI), Enterprise Products Partners (EPD), Energy Transfer (ET), MPLX (MPLX), and Williams Companies (WMB).

Natural gas prices also impact midstream stocks, which we’ll discuss in the next part.