What to Expect of Home Depot’s Revenue in 2019

Home Depot’s (HD) management team expects its revenue to rise 3.3% this year, which also accounts for an extra week of operations in 2018.

April 8 2019, Published 12:58 p.m. ET

Analysts’ recommendations

Home Depot’s (HD) management team expects its revenue to rise 3.3% this year, which also accounts for an extra week of operations in 2018. For 2019, management projects SSSG at 5.0% and plans to open five new stores.

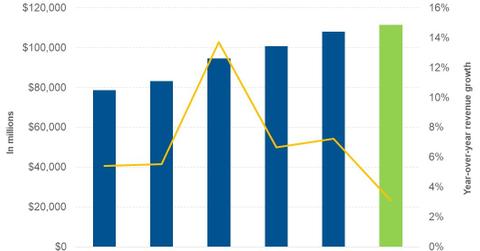

Analysts expect the company’s revenue growth to fall in 2019. For 2019, analysts expect Home Depot to post revenue of $111.6 billion, which represents a rise of 3.1% from $108.2 billion in 2018. In 2018, the company’s revenue grew 7.2%.

The positive SSSG and opening of new stores are expected to drive the company’s revenue, while one fewer week of operations is expected to offset some of the increase in the company’s revenue.

Home Depot is focusing on improving delivery and fulfillment options, enhancing customers’ experience through an interconnected shopping experience, improving customer satisfaction, and expanding its product offerings to drive same-store sales growth.

Last June, the company’s management team announced that it would invest $1.2 billion to strengthen the supply chain and improve its efficiency over the next five years. During this period, Home Depot plans to add 170 distribution facilities to deliver products to 90% of the US population within one day.

Home Depot has been working on implementing digital advancements to enhance customers’ shopping experience. The company has launched a new B2B website experience that delivers more personalized product offerings to professional customers. At the time of the announcement of its fourth-quarter earnings, the company had rolled out automated lockers in 1,000 stores. To improve convenience for “order online, pick up in store” customers, the company is expanding the facility to other stores.

In the last quarter, the company’s paint department posted above-average SSSG. The company is planning to roll out a new color solutions center in all of its stores and fully reset its exterior stains to maintain sales growth.