NVS or BMY: Who’s Expected to Post Faster Revenue Growth in 2019?

According to the company’s fourth-quarter earnings conference call, Novartis expects to complete the spin-off of its Alcon business in the second quarter of 2019.

Aug. 1 2019, Updated 7:57 p.m. ET

Revenue guidance in fiscal 2019

In its fourth-quarter earnings investor presentation, Novartis (NVS) provided guidance for two scenarios. If the company retains its current group structure, Novartis has guided for low to mid-single-digit YoY net sales growth for fiscal 2019. This estimate is based on assumptions of YoY mid-single-digit revenue growth for the Innovative Medicines business, YoY low to mid-single-digit revenue growth for the Alcon business, and a YoY revenue decline in the low single digits for its Sandoz business in fiscal 2019.

According to the company’s fourth-quarter earnings conference call, Novartis expects to complete the spin-off of its Alcon business in the second quarter of 2019. The company has planned to complete the divestiture of its Sandoz dermatology business and generic oral solids portfolio in the US to Aurobindo Pharma USA in 2019. According to Novartis’s fourth-quarter earnings investor presentation, the new focused medicines company formed after the completion of these deals is expected to grow its revenues YoY by mid-single digits. This estimate is based on assumptions of YoY mid-single digit revenue growth for the Innovative Medicines business and flat YoY revenue performance for the Sandoz business.

In its investor presentation, Bristol-Myers Squibb (BMY) has guided for pro-forma revenues of around $41 billion, $49 billion, and $53 billion, in fiscal 2019, fiscal 2022, and fiscal 2025, respectively. These projections assume the completion of the acquisition of Celgene in the third quarter of 2019. The proposed deal, however, is not being favored by certain Bristol-Myers Squibb shareholders such as Starboard Value and Wellington Management.

According to Bristol-Myers Squibb’s fourth-quarter earnings press release, excluding the impact of the Celgene acquisition, Bristol-Myers Squibb is expected to report mid-single-digit YoY revenue growth in fiscal 2019.

Wall Street’s projections

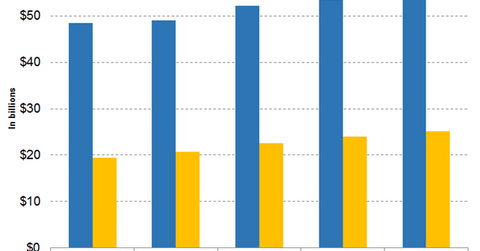

Wall Street analysts have projected Novartis’s revenues to be $53.52 billion, $56.03 billion, and $58.81 billion, for fiscal 2019, fiscal 2020, and fiscal 2021, respectively, which implies a YoY revenue change of 3.13%, 4.69%, and 4.96% for fiscal 2019, fiscal 2020, and fiscal 2021, respectively.

On the other hand, Wall Street analysts have projected Bristol-Myers Squibb’s revenues to be $23.98 billion, $25.10 billion, and $26.20 billion, for fiscal 2019, fiscal 2020, and fiscal 2021, respectively, which implies a YoY revenue change of 6.28%, 4.70%, and 4.38% for fiscal 2019, fiscal 2020, and fiscal 2021, respectively. These projections do not include the revenue contribution from the Celgene business if the deal is completed according to schedule.

While Novartis is expected to report higher absolute revenues, Bristol-Myers Squibb is expected to report a higher revenue growth rate from fiscal 2018 to fiscal 2021.

Next, we’ll discuss EPS projections for Novartis and Bristol-Myers Squibb in fiscal 2019.