NRG Energy’s Valuation Compared to Its Peers

Currently, NRG Energy (NRG) stock is trading at a forward PE ratio of 8.5x based on its estimated EPS in 2019.

Nov. 20 2020, Updated 5:14 p.m. ET

Valuation

Currently, NRG Energy (NRG) stock is trading at a forward PE ratio of 8.5x based on its estimated EPS in 2019. In comparison, peers’ average forward PE ratio is close to 15x–16x. NRG Energy stock looks attractively valued considering its lower forward PE ratio compared to peers’ average. NRG Energy seems to be trading at an alluring valuation given the company’s superior estimated EPS growth for 2019.

One of the smallest utilities in the Utilities ETF (XLU), AES (AES) stock is trading at a valuation multiple of 12.0x based on analysts’ projected EPS for 2019. In comparison, AES appears to be trading at a discounted valuation compared to its peers and its historical average.

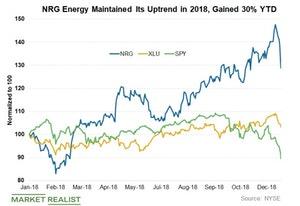

The recent weakness in broader markets hasn’t spared defensives like utilities. The Utilities Select Sector SPDR ETF (XLU) has fallen more than 10% in the last five trading sessions. To learn how utilities played out and how they seem placed for the future, read Utilities: How the Worst Week for Markets Played Out.