How Railroads’ Free Cash Flow Stacks Up

Free cash flow (or FCF) is an important metric in the railroad (FXR) industry.

Oct. 1 2018, Updated 10:33 a.m. ET

Free cash flow

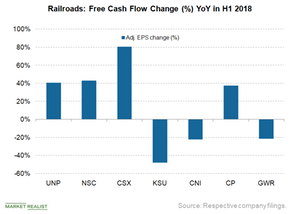

Free cash flow (or FCF) is an important metric in the railroad (FXR) industry. Companies primarily use FCF to buy back stock, pay dividends, and reinvest in their business. Let’s compare major US railroads’ FCF growth in H1 2018.

CSX sees highest FCF growth

In the first half of 2018, CSX’s (CSX) adjusted FCF before dividends jumped 80% YoY (year-over-year) to $1.3 billion from $737.0 million, mainly due to 33% YoY growth in its net operating cash flow.

NSC’s FCF growth comes in second

Norfolk Southern (NSC) followed rival CSX with 42.9% FCF growth YoY in H1 2018. NSC’s FCF rose YoY to $990.0 million from $693.0 million, while its capital expenditure fell by ~$50.0 million YoY and its cash from operations rose ~16%.

Other railroads’ FCF

In H1 2018, Union Pacific’s (UNP) FCF grew 40.2% YoY to $1.2 billion from $915.0 million. The railroad’s FCF growth was much better than peers’ given the scale of its operations.

As shown in the graph above, Kansas City Southern (KSU), Canadian National Railway (CNI), and Genesee & Wyoming (GWR) reported a YoY decline in their H1 2018 FCF. KSU’s FCF declined 47.7% YoY to $41.6 million from $79.5 million due to a 14% rise in its capital expenditure and 2% operating cash flow growth. CNI’s FCF declined 21.3% YoY to $1.3 billion, and GWR’s FCF fell 21.4% YoY to $102.5 million from $130.0 million. In the next part, we’ll conclude this series by comparing major railroads’ capital-to-revenue ratios in the first six months of 2018.