Does Valero Have a Comfortable Debt Position?

Valero Energy’s (VLO) net debt-to-EBITDA ratio was 1.2x in the first quarter of 2019, lower than the peer average of 1.6x.

May 15 2019, Published 1:35 p.m. ET

Valero’s debt compared to its peers’

Valero Energy’s (VLO) net debt-to-EBITDA ratio was 1.2x in the first quarter of 2019, lower than the peer average of 1.6x. The average peer ratio considers six refining companies. The ratio portrays a company’s debt level as a multiple of its earnings. The lower the rate, the better the debt position.

In the first quarter, Valero’s total debt-to-capital ratio stood at 32%, below the peer average of 36%. The debt-to-capital ratio displays the percentage of debt in a company’s capital structure. Marathon Petroleum’s (MPC), HollyFrontier’s (HFC), and Phillips 66’s (PSX) total debt-to-capital ratios stood at 39%, 27%, and 30%, respectively, in the first quarter.

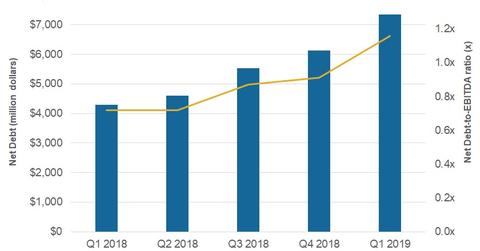

Valero’s net debt-to-EBITDA ratio trend

Valero’s net debt-to-adjusted EBITDA ratio stood at 1.2x in the first quarter of 2019, higher than in the first quarter of 2018. The rise in the ratio was the result of a steeper increase in its net debt than the surge in its trailing-12-month adjusted EBITDA.

The company’s net debt rose due to a rise in its total debt and a fall in its cash from the first quarter of 2018 to the first quarter of 2019 due to capex and growth activities coupled with shareholder returns in the form of dividends and share repurchases. In the first quarter, Valero raised its debt and completed the purchase of its midstream MLP, Valero Energy Partners.

Further, Valero’s adjusted trailing-12-month EBITDA rose because of higher earnings from its core Refining segment.

What does Valero’s debt position suggest?

Valero has increased its debt in the current quarter. Despite the rise in its total debt, the company’s debt ratios are below the industry average—a comfortable situation, implying that Valero has the financial power to manage in a challenging environment.

Going forward, Valero will have to manage the effects of volatile refining earnings, ongoing capex, shareholder returns, and volatile RIN (renewable identification number) expenses on its financial strength and flexibility—a tall order that investors will likely keep a close eye on.