Highest Dividend Growth: Comparing NEE, EIX, and AWK

Utilities have been weak compared to the broader markets this year largely due to the strength in the Treasury yields.

Nov. 20 2020, Updated 5:20 p.m. ET

Market performance

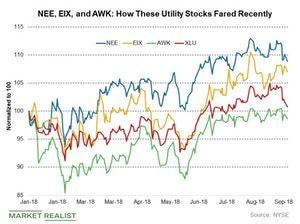

Utilities have been weak compared to the broader markets this year largely due to the strength in the Treasury yields. So far this year, the Utilities Select Sector SPDR ETF (XLU), a representative of S&P 500 utilities stocks, is up marginally, while the broader markets have surged 9%.

In this series, we’re comparing utility stocks NextEra Energy (NEE), Edison International (EIX), and American Water Works (AWK), the three utilities that have reported the highest dividend growth over the last five years.

Total returns

Among these utilities, NextEra Energy stock has outperformed its peers this year. It’s up more than 8% so far in 2018.

Let’s compare these stocks’ total returns over the last five years. NextEra Energy has returned 18% (including dividends) in the last year, while in the last five years, it’s returned 18% compounded annually.

American Water Works has returned 9% and 18% in the last one and five years, respectively. Edison International has returned -11% in the last year and 10% in the last five years.

You can compare the performances of Edison International and its regional peers Sempra Energy (SRE) and PG&E Corporation (PCG) in A Look at California Utilities: Who Will Emerge Strong?A Look at California Utilities: Who Will Emerge Strong?

Among the utilities that offer the highest dividend growth, NEE forms more than 11%, EIX forms 3.1%, and AWK forms 2.4% of XLU.

Read how broader utilities performed last week in our series How Utilities Performed in the Week Ended September 21How Utilities Performed in the Week Ended September 21.