Who’s Eating Up the iPhone’s Market Share in China?

According to the IDC report, Apple’s smartphone market share fell to 11.5% in the quarter that ended in December 2018.

Feb. 19 2019, Updated 2:30 p.m. ET

Apple’s China troubles

In the previous article, we looked at the recent massive fall in Apple’s (AAPL) iPhone sales in the Chinese market, which was discussed in a report by the IDC.

The report suggested that total Chinese shipment (FXI) (MCHI) volumes of all companies fell 9.7% YoY (year-over-year) in the quarter that ended in December 2018, while Apple’s iPhone shipments to China tanked 19.9% YoY. This massive fall in the iPhone’s shipments to China gave local smartphone makers the opportunity to nab the market share Apple had lost.

Apple iPhone’s falling market share

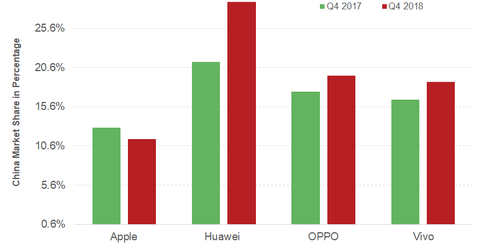

According to the IDC report, Apple’s smartphone market share fell to 11.5% in the quarter that ended in December 2018 compared to 12.9% in the quarter that ended in December 2017.

In contrast, Chinese smartphone makers Huawei, OPPO, and Vivo registered sharp rises in their home market shares in the smartphone space. Huawei’s, OPPO’s, and Vivo’s smartphone market shares in China were 29.0%, 19.6%, and 18.8%, respectively in the quarter that ended in December 2018 compared to 21.3%, 17.5%, and 16.5%, respectively, in the quarter that ended in December 2017.

Similarly, while Apple’s 2018 Chinese smartphone market share fell to 9.1% from 9.3% a year ago, Huawei’s 2018 Chinese smartphone market share rose to 26.4% from 20.4% a year ago.

What does this mean for Apple investors?

The fall in the iPhone’s Chinese market share could be troublesome for Apple, as it reflects iPhone users’ willingness to switch to Android smartphones if new iPhones aren’t able to meet their expectations. In the ongoing quarter, investors could remain focused on the trend in iPhone’s Chinese market sales, which could have an effect on Apple stock.

As of February 15, Apple has risen 8.0% compared to the 10.7% and 12.6% rises in the S&P 500 Index (SPY) and the NASDAQ Composite Index (QQQ), respectively.

In the next article, we’ll review Apple’s efforts to revive its Chinese sales.