Should You Look to European Stocks for Growth?

European stocks began the year with a lot of hope pinned on them for providing capital appreciation in the year.

Feb. 22 2016, Published 7:02 p.m. ET

High hopes from European stocks

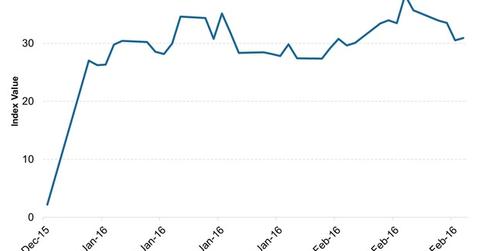

2016 has not begun well for stock markets, including Europe’s. Declines in crude oil prices and concerns regarding China have led to a surge in the volatility index, or “fear index.” Has this dented hopes from European equities?

Volatility has been the order of the day, as exhibited by the EURO STOXX 50 Volatility Index in the graph above. European stocks began the year with a lot of hope pinned on them for providing capital appreciation in the year. BlackRock, the world’s biggest asset manager, in its 2016 investment outlook, expressed that it saw US equities as fully valued and saw opportunity in European and Japanese equities.

European stocks surged on January 21, 2016, after Mario Draghi, chief of the ECB (European Central Bank), hinted that the central bank may come up with more stimulus measures in its next meeting in March 2016. This came as a surprise, as action was expected to be taken much later than in March. The central bank expanded stimulus measures for the Eurozone on December 3 by reducing its deposit rate by 10 basis points to -0.3% and extending the duration of its asset purchase program to March 2017, and beyond, if required.

Draghi reinforced these views on February 15, stating that given the significant challenges being faced by the Eurozone, policymakers will require to put in a strong effort. Banco Santander (SAN), ING Group (ING), and UniCredit (UNCFF) rose after the ECB chief’s comments.

Will stimulus keep driving European stocks?

Monetary stimulus can do only so much. They are tools that can stoke a latent but potent fire in an economy by gently stirring things up. However, they can’t ignite a fire. Due to diverging monetary policies being followed by the United States and Europe, the euro is expected to decline, thereby boosting European exports. This should help companies garner higher revenues and post strong results.

However, with China slowing down, and other emerging markets witnessing testing times, the demand for European products may not be quite as strong as anticipated. If there’s little demand, who will one sell to, even with the weak currency, which would make products cheaper? Though things may not be quite as bad as 2016 pans out, investors should keep an eye on this aspect to ensure that this macro development does not pummel their financial investments.

In this series, we’ll look at 12 Europe-focused mutual funds (HFEAX) (EGINX) and see how they’ve fared in 2015 as well as the one-year period ended February 16, 2016. We’ll look at quantitative metrics and provide you insights into how the fund is placed for now and what you can do with the fund. Let’s begin our fund-by-fund analysis with the Invesco European Growth Fund – Class A (AEDAX).