Pfizer or Eli Lilly: Who Will Report Better Revenue Growth?

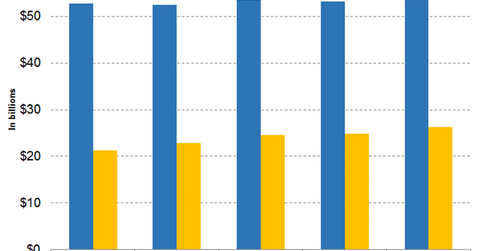

In its fourth-quarter earnings conference call, Pfizer (PFE) has guided for revenues of $52 billion to $54 billion for fiscal 2019.

Feb. 12 2019, Updated 3:10 p.m. ET

Revenue guidance for fiscal 2019

In its fourth-quarter earnings conference call, Pfizer (PFE) has guided for revenues of $52 billion to $54 billion for fiscal 2019 driven by the anticipated uptake of drugs such as Xtandi, Eliquis, Ibrance, and Xeljanz as well as by the favorable impact of label expansions and new product launches. This guidance assumes the negative impact of $2.6 billion due to generic erosion for drugs that have recently lost patent protection and those that will be losing patent protection in coming months such as Viagra and Lyrica. The company has also guided for a negative impact of $900 million associated with foreign exchange.

In its fourth-quarter earnings press release, Eli Lilly (LLY) has guided for revenues of $25.1 billion to $25.6 billion for fiscal 2019 driven by an anticipated increase in sales volumes of drugs such as Taltz, Cyramza, Jardiance, Olumiant, Verzenio, Basaglar, and Trulicity. According to the press release, the company also expects to benefit from the recent launch of Emgality as migraine prophylaxis therapy and the addition of oral TRK inhibitor Vitrakvi, which will be added to Eli Lilly’s portfolio, subsequent to the completion of the acquisition of Loxo Oncology (LOXO).

Eli Lilly’s new fiscal 2019 revenue guidance is slightly lower than the company’s prior revenue guidance of $25.3 billion to $25.8 billion due to the company’s setback from its Lartruvo research program.

Wall Street’s projections

Analysts expect Pfizer’s revenue to rise 0.83% YoY to $13.01 billion in the first quarter, then drop 0.88% YoY to $53.18 billion in fiscal 2019, then rise 1.50% YoY to $53.97 billion in fiscal 2020, and then rise 4.96% YoY to $56.65 billion in fiscal 2021.

Analysts expect Eli Lilly’s revenue to rise 1.76% YoY to $5.80 billion in the first quarter, 1.45% YoY to $24.91 billion in fiscal 2019, 5.33% YoY to $26.24 billion in fiscal 2020, and 5.47% YoY to $27.67 billion in fiscal 2021.

Although Eli Lilly’s absolute revenues are lower than those of Pfizer, Wall Street analysts expect the former to grow its revenues at a faster-reported rate until 2021.

Next, we’ll discuss EPS projections for Pfizer and Eli Lilly in fiscal 2019.