PepsiCo’s Valuation ahead of 1Q17 Results

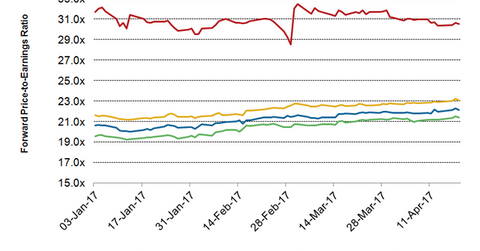

As of April 19, PepsiCo (PEP) was trading at a 12-month forward PE (price-to-earnings) ratio of 22.1x.

Nov. 20 2020, Updated 2:23 p.m. ET

12-month forward PE

As of April 19, PepsiCo (PEP) was trading at a 12-month forward PE (price-to-earnings) ratio of 22.1x. The company’s forward PE ratio has risen 6.4% since the announcement of its results in February 2017. The company is currently trading at a higher valuation multiple than the S&P 500 Index (forward PE of 18.3x).

Comparison with peers

PepsiCo’s valuation multiple is currently lower than Coca-Cola (KO) and Monster Beverage’s (MNST) but higher than Dr Pepper Snapple’s (DPS). As of April 19, Coca-Cola, Dr Pepper Snapple, and Monster Beverage were trading at 12-month forward PEs of 23.1x, 21.4x, and 30.5x, respectively.

PepsiCo constitutes 4.7% of the iShares Global Consumer Staples ETF (KXI). PepsiCo’s valuation multiple is higher than the S&P 500 Consumer Staples Index, which was trading at a 12-month forward PE of 21.4x as of April 19.

The 12-month forward PE varies among companies based on several factors, like growth expectations, business models, leverage, and risk-return profile.

Growth expectations

Currently, analysts expect PepsiCo’s revenue to rise 1.0% to $63.4 billion. The company’s adjusted EPS (earnings per share) is expected to rise 5.8% to $5.13. PepsiCo’s innovation and revenue management strategies are expected to drive its growth. However, currency headwinds and macro uncertainties in certain markets might weigh on the results of the company in the current fiscal year.

For more updates, visit our Nonalcoholic Beverages page.