AstraZeneca or Eli Lilly: Which Is Controlling Expenses Better?

In its fourth-quarter earnings press release, AstraZeneca (AZN) guided for a low single-digit YoY (year-over-year) rise in core operating expenses in fiscal 2019.

March 1 2019, Updated 7:31 a.m. ET

Expense guidance for fiscal 2019

In its fourth-quarter press release, AstraZeneca (AZN) guided for a low single-digit YoY (year-over-year) rise in core operating expenses in fiscal 2019. In its fourth-quarter investor presentation, Eli Lilly (LLY) reiterated its fiscal 2019 marketing, selling, and administrative expense guidance of $6.4 billion–$6.7 billion. It raised its R&D (research and development) expense guidance for fiscal 2019 from $5.6 billion–$5.8 billion to $5.8 billion–$6.0 billion to account for the increased spending on the research pipeline of recently acquired Loxo Oncology.

Since Eli Lilly plans to divest its entire stake in Elanco Animal Health, its growth potential depends more on its pharmaceutical portfolio. In its fourth-quarter earnings investor presentation, Eli Lilly reiterated its fiscal 2019 marketing, selling, and administrative expense guidance of $5.7 billion–$6.0 billion, and raised its fiscal 2019 R&D expense guidance from $5.3 billion–$5.5 billion to $5.5 billion–$5.7 billion for its pharma business.

Wall Street’s projections

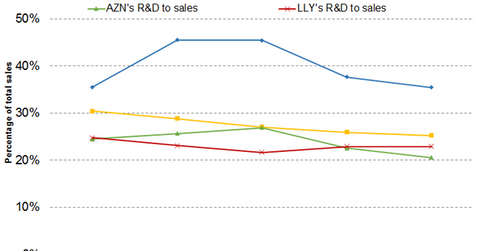

Wall Street analysts expect AstraZeneca’s SG&A (selling, general, and administrative) expense-to-sales ratio to be 37.60%, 35.44%, and 34.41% in fiscal 2019, fiscal 2020, and fiscal 2021, respectively. Meanwhile, they project Eli Lilly’s SG&A expense-to-sales ratio to be 25.91%, 25.23%, and 24.62% in fiscal 2019, fiscal 2020, and fiscal 2021, respectively.

Analysts project AstraZeneca’s R&D expense-to-sales ratio to be 22.53%, 20.51%, and 19.43% in fiscal 2019, fiscal 2020, and fiscal 2021, respectively. They project Eli Lilly’s R&D expense-to-sales ratio to be 22.89%, 22.88%, and 22.28% in fiscal 2019, fiscal 2020, and fiscal 2021, respectively. Therefore, compared with AstraZeneca, Eli Lilly is expected to allocate a lower percentage of sales to SG&A activities and a higher percentage of sales to R&D activities. Next, we’ll discuss AstraZeneca’s and Eli Lilly’s dividend and capex trends.