AbbVie or Celgene: Which Is Expected to Report Faster EPS Growth?

On its fourth-quarter earnings conference call, AbbVie (ABBV) guided for an adjusted gross margin of 82.5% in 2019.

Feb. 8 2019, Updated 7:32 a.m. ET

Margin projections for 2019

On its fourth-quarter earnings conference call, AbbVie (ABBV) guided for an adjusted gross margin of 82.5% in 2019, up 270 basis points YoY (year-over-year), and an operating margin of 46.5%, up 200 basis points YoY.

Analysts expect AbbVie’s adjusted gross margin to expand 276 basis points YoY to 82.95% in the first quarter and 205 basis points YoY to 82.62% in 2019. They then expect it to contract 58 basis points YoY to 82.04% in 2020 and by an additional 83 basis points YoY to 81.21% in 2021. Analysts expect AbbVie’s adjusted operating margin to be 44.46% in 2019.

In its fourth-quarter earnings press release, Celgene (CELG) said that it expects its GAAP (generally accepting accounting principles) operating margin and non-GAAP operating margin to be ~49% and 57.5%, respectively, in 2019.

Analysts expect Celgene’s adjusted gross margin to contract 34 basis points YoY to 96.10% in the first quarter and five basis points YoY to 96.11% in 2019. They then expect it to expand by one basis point YoY to 96.12% in 2020 and again contract 30 basis points YoY to 95.82% in 2021.

Celgene is expected to report significantly higher gross margins and operating margins in the coming years.

EPS guidance for 2019

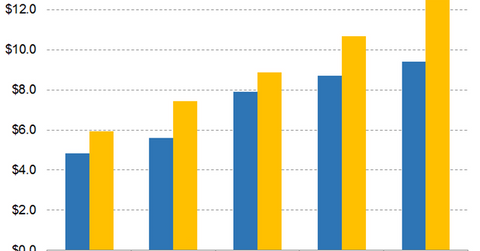

On its fourth-quarter earnings conference call, AbbVie guided for adjusted EPS of $2.05–$2.07 in the first quarter and $8.65–$8.75 in 2019. Analysts expect AbbVie’s adjusted diluted EPS to rise 9.00% YoY to $2.04 in the first quarter, 9.93% YoY to $8.70 in 2019, 8.32% YoY to $9.42 in 2020, and 8.27% YoY to $10.20 in 2021.

On its fourth-quarter earnings conference call, Celgene guided for GAAP diluted EPS and adjusted diluted EPS of $8.40–$9.08 and $10.60–$10.80, respectively, in 2019. Analysts expect Celgene’s adjusted diluted EPS to rise 22.40% YoY to $2.51 in the first quarter, 20.23% YoY to $10.66 in 2019, 17.68% YoY to $12.55 in 2020, and 16.77% YoY to $14.66 in 2021.

In addition to having higher absolute EPS, Celgene is expected to grow its EPS at a faster rate than AbbVie until 2021.

Next, we’ll discuss expense projections for AbbVie and Celgene in 2019.