Teva Pharmaceutical or Mylan: Which Has the Better Debt Profile?

In the first nine months of 2018, Teva Pharmaceutical (TEVA) reduced its net debt level by $3.9 billion to $27.6 billion.

Jan. 10 2019, Updated 10:30 a.m. ET

Debt changes in 2018

In the first nine months of 2018, Teva Pharmaceutical (TEVA) reduced its net debt level by $3.9 billion to $27.6 billion. According to the company’s third-quarter earnings conference call, it deployed the proceeds it received from its issuance of new corporate bonds to repay its term loans as well as part of its bonds.

The company has also been focusing on using its cash flows to reduce its net debt levels. At the end of September 2018, the company had gross debt of below $30 billion and cash worth $1.9 billion.

At the end of September 2018, Mylan (MYL) had a net debt-to-adjusted EBITDA ratio of 3.8x. According to Mylan’s third-quarter earnings conference call, the company is targeting the repayment of $1.2 billion worth of debt by the end of 2019.

Debt projections

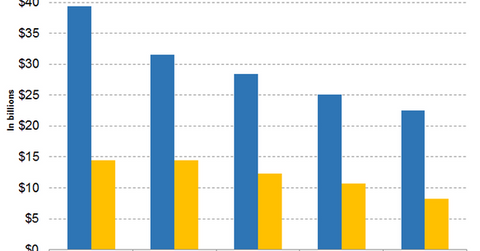

Analysts expect Teva Pharmaceutical’s net debt to be $28.37 billion, $25.06 billion, and $22.47 billion, respectively, at the end of 2018, 2019, and 2020. The company is expected to reduce its net debt levels by 9.97%, 11.66%, and 10.33% YoY (year-over-year), respectively, in 2018, 2019, and 2020.

Analysts expect Mylan’s net debt to be $12.36 billion, $10.66 billion, and $8.27 billion, respectively, at the end of 2018, 2019, and 2020. The company is expected to reduce its net debt levels by 14.34%, 13.78%, and 22.36% YoY, respectively, in 2018, 2019, and 2020.

Analysts expect Teva Pharmaceutical’s net debt-to-adjusted EBITDA ratios to be 5.26x, 4.76x, and 4.14x, respectively, in 2018, 2019, and 2020. They expect Mylan’s net debt-to-adjusted EBITDA ratios to be 3.28x, 2.66x, and 1.95x, respectively, in 2018, 2019, and 2020.

Compared to Teva Pharmaceutical, Mylan not only has a lower absolute level of net debt but is also expected to reduce its debt levels at a much faster pace from 2018 to 2020.