How Home Depot Aims to Drive Its Sales

Home Depot’s integrated retail strategy To counter Amazon (AMZN), Home Depot (HD) has been focusing on its integrated retail strategy, One Home Depot. The strategy integrates its offline and online channels to enhance customers’ experience, which could be hard for Amazon to replicate. In last year’s third quarter, the company’s online sales grew 28%, and […]

Jan. 14 2019, Updated 2:25 p.m. ET

Home Depot’s integrated retail strategy

To counter Amazon (AMZN), Home Depot (HD) has been focusing on its integrated retail strategy, One Home Depot. The strategy integrates its offline and online channels to enhance customers’ experience, which could be hard for Amazon to replicate.

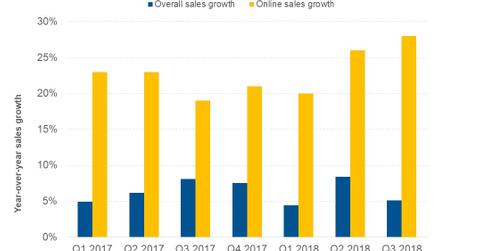

In last year’s third quarter, the company’s online sales grew 28%, and its overall revenue grew 5.1%. Its buy-online, ship-to-store and buy-online, pick-up-in-store sales both outpaced its overall online sales.

Home Depot’s initiatives

To drive sales, Home Depot is also focusing on improving its delivery time and fulfillment options and expanding its product offerings. In June, the company announced that it would be investing $1.2 billion in strengthening its supply chain and improving its delivery speed over the next five years. The company plans to add 170 distribution facilities to be able to deliver products to 90% of the US population within one day.

As part of this initiative, the company launched its express delivery service on September 26, which would make it possible to deliver more than 20,000 of its products on the same day or the following day in 35 major US markets. Home Depot has partnered with Roadie and Deliv for express delivery of smaller products, and the company is expanding its supply chain network for bulk product delivery.

Analysts’ revenue estimates

On the back of these initiatives, analysts expect Home Depot’s revenue to rise by 7.3% YoY (year-over-year) to $108.31 billion from $100.90 billion. However, they expect its revenue growth to slow to 3.3% this year.

Lowe’s (LOW), Williams-Sonoma’s (WSM), and Bed Bath & Beyond’s (BBBY) revenue is expected to have grown 4.1%, 6.5%, and -2.5%, respectively, last year. Next, we’ll look at analysts’ EPS expectations.