Suncor: How Analysts Are Rating the Stock after Earnings

An analyst survey shows that six out of eight companies surveyed rated Suncor Energy (SU) an “overweight” or “outperform.”

Oct. 27 2016, Published 1:35 p.m. ET

Majority of analysts rate Suncor a “buy”

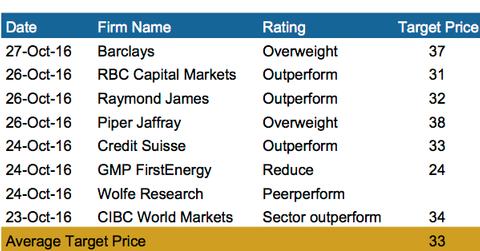

An analyst survey shows that six out of eight companies surveyed rated Suncor Energy (SU) an “overweight” or “outperform.” The highest and lowest 12-month price targets stand at $38 and $24, indicating a 29% rise and a 19% fall from its current levels, respectively. Only GMP FirstEnergy gave SU a “reduce” rating. The average price target, at $33, implies an 11% gain.