Coca-Cola and PepsiCo: Who’s Delivering Better Margins?

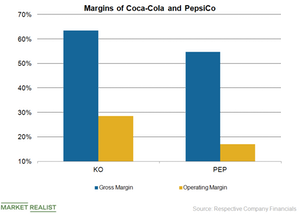

Coca-Cola (KO) has outperformed PepsiCo (PEP) by generating a better gross and operating margin in the first nine months of 2018.

Dec. 14 2018, Updated 3:40 p.m. ET

Margin comparison

Coca-Cola (KO) has outperformed PepsiCo (PEP) by generating a better gross and operating margin in the first nine months of 2018. Coca-Cola’s gross margin increased to 63.5% in the first nine months of 2018—compared to 62.1% in the first nine months of 2017. The significant improvement reflected the impact of the company’s refranchising efforts. The improvement was partially offset by the adoption of a new revenue recognition standard. Coca-Cola has been refranchising its bottling operations to improve its profitability by bringing down its exposure to the lower-margin and capital-intensive bottling operations.

PepsiCo’s gross margin declined by 50 basis points to 54.7% in the first nine months of 2018 due to commodity inflation and higher transportation costs.

Coca-Cola’s operating margin of 28.5% in the first nine months of 2018 is higher than PepsiCo’s operating margin of 17.0%. Coca-Cola’s operating margin expanded by 610 basis points in the first nine months of 2018, which reflected the favorable impact of refranchising and the company’s productivity initiatives. However, the negative impact of a new revenue recognition standard and currency fluctuations had a negative impact on the company’s operating margin.

PepsiCo’s operating margin declined by 50 basis points to 17.0% in the first nine months of 2018 due to higher operating costs and a rise in marketing and advertising expenses.

Focus on productivity

Coca-Cola and PepsiCo have been streamlining their operations and implementing several productivity measures to improve their margins. Coca-Cola expects to generate annualized productivity savings of $3.8 billion by 2019. Coca-Cola is driving efficiencies in its supply chain and marketing expenditures. The company is also working towards a more agile operating model.

PepsiCo’s 2014 restructuring plan aims to deliver annualized productivity savings of $1 billion from 2015 to 2019. The company has been increasing its efficiency through several initiatives including manufacturing automation and optimizing its manufacturing footprint.

Higher commodity costs and increased freight costs are expected to continue to put pressure on beverage giants’ margins.