MLPs Continue to Outperform Broader US Markets in 2018

MLPs maintained their winning streak in the second week of 2018. The Alerian MLP Index (^AMZ) rose 4.6% last week and ended at 300.5.

Jan. 16 2018, Published 1:19 p.m. ET

AMZ rose 5.0% last week

MLPs maintained their winning streak in the second week of 2018. The Alerian MLP Index (^AMZ), which includes 50 energy MLPs, rose 4.6% last week and ended at 300.5. Overall, the index has risen 9.2% since the beginning of 2018. AMZ is outperforming the S&P 500 Index (^GSPC) (SPX-INDEX), which represents the broader US markets. GSPC has risen 4.2% in the past two weeks.

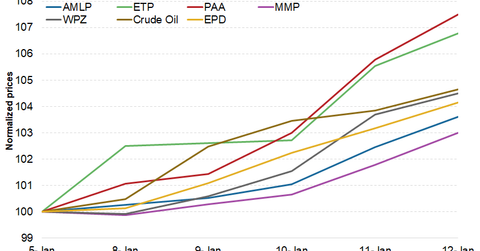

Out of the total 93 MLPs, 76 ended in the green, one remained unchanged, and remaining 16 ended in the red. Among the top MLPs, Plains All American Pipelines (PAA), Energy Transfer Partners (ETP), Williams Partners (WPZ), and Enterprise Products Partners (EPD) rose 7.5%, 6.8%, 6.5%, and 4.2%, respectively. Later in this series, we’ll discuss the performance drivers for the top MLP losers and gainers. The Alerian MLP ETF (AMLP) ended 3.6% higher in week 2.

Last week, MLPs’ rise could have been due to strong crude oil and natural gas prices, the rise in natural gas demand, attractive valuations, and positive rating updates. US crude oil ended the week 4.7% higher at $64.3 per barrel. Read What Could Be the High for US Crude Oil Next Week? for an update on crude oil prices.

Fund flows

AMLP saw a net inflow of $75.2 million in funds last week. It could be attributed to the sector’s strong gains. The JP Morgan Alerian MLP Index ETN (AMJ) saw a net inflow of $3.6 million in funds.

Next, we’ll discuss the top MLP gainers last week.