How Analysts View Alexion Stock

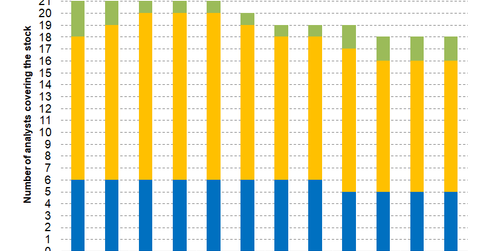

In November 2018, of the total 18 analysts covering Alexion Pharmaceuticals (ALXN), 16 analysts have given the stock a “buy” or higher rating, and two analysts have given it a “hold” rating.

Nov. 9 2018, Updated 10:30 a.m. ET

Analysts’ recommendations

In November 2018, of the total 18 analysts covering Alexion Pharmaceuticals (ALXN), 16 analysts have given the stock a “buy” or higher rating, and two analysts have given it a “hold” rating. The mean rating for Alexion Pharmaceuticals stock is 1.83 with a target price of $163.29, implying an upside potential of 28.4% over Alexion Pharmaceuticals’ closing price of $127.18 on November 10, 2018.

Peer ratings

In comparison, for peers Abbott Laboratories (ABT), Amgen (AMGN), and Johnson & Johnson (JNJ), analysts have a mean rating of 1.8, 2.33, and 2.32, respectively, and a target price of $78.94, $204.7, and $146.78, respectively.

Alexion Pharmaceuticals’ long-term debt-to-equity ratio stands at 0.32x. In comparison, the long-term debt-to-equity ratios of peers Abbott Laboratories (ABT), Amgen (AMGN), and Johnson & Johnson (JNJ) stand at 0.63x, 2.05x, and 0.46x, respectively.

Alexion Pharmaceuticals’ price-to-free-cash-flow ratio stands at 83.06x. In comparison, the price-to-free-cash-flow ratios of peers Abbott Laboratories (ABT), Amgen (AMGN), and Johnson & Johnson (JNJ) stand at 42.94x, 18.99x, and 42.57x, respectively.

The enterprise value of Alexion Pharmaceuticals is $29.43 billion, and its enterprise-value-to-revenue ratio is 7.86x. The stock is trading at a forward price-to-earnings multiple of 14.64x. Its price-to-sales ratio is 7.58x, and its price-to-book ratio is 3.23x.

Its current ratio, a metric of how effectively a company can meet its short-term obligations, stands at 3.20x. In comparison, the current ratios of peers Abbott Laboratories (ABT), Amgen (AMGN), and Johnson & Johnson (JNJ) stand at 1.40x, 3.10x, and 1.70x, respectively.