What’s Driving The Cheesecake Factory’s Revenue Growth?

The Cheesecake Factory earns its revenue from its company-owned restaurant sales, franchisee fees and royalties, and its bakery operations.

June 6 2016, Updated 11:11 a.m. ET

Revenue sources

Let’s discuss The Cheesecake Factory’s (CAKE) overall revenue and the revenue it derives from its different segments. CAKE earns revenue from its company-owned restaurants’ sales, franchisee fees and royalties, and its bakery operations.

The sales from The Cheesecake Factory brand’s company-owned restaurants are shown above as restaurant sales. Revenue from all other operations is reflected in the Others category.

The company is responsible for the day-to-day operations of its company-owned restaurants. It bears all the costs involved in their operations and keeps all the revenue they generate.

Revenue growth

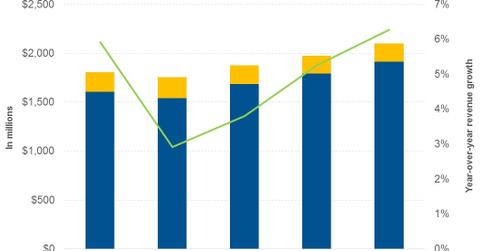

To gain an understanding of how CAKE is doing, we’re considering its last five years of revenue. From 2011 to 2015, CAKE’s revenue rose from $1.8 billion to $2.1 billion, representing a rise of 16.1%.

In the same period, CAKE’s revenue from its company-owned restaurant sales rose from $1.6 billion to $1.9 billion, a rise of 19.3%. During the same period, the revenue from its Others category fell from $204.2 million to $186.9 million, a fall of 8.4%.

Unit growth and same-store sales growth drove CAKE’s company-owned restaurants’ revenues, while a fall in Grand Lux Cafe’s unit count and negative same-store sales growth contributed to the revenue fall in the Others category.