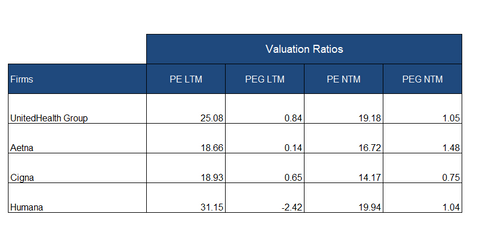

We’ll look at a growth-neutral valuation metric, the PEG (price-to-earnings-to-growth) ratio, for UNH’s valuation. It is a key valuation multiple used for the comparison of companies with different growth profiles in different industries. On October 3, UNH had a 12-month forward PEG ratio of ~1.05x. Peers Aetna (AET), Humana (HUM), and Cigna (CI) had forward PEG ratios of 1.5x, 1.0x, and 0.75x, respectively. Their forward PEs were 16.7x, 19.9x, and 14.2x, respectively.

Be sure to check out all the data we’ve added to our quote pages. Now you can get a valuation snapshot, earnings and revenue estimates, and historical data, as well as dividend information. Take a look!