A Financial Overview of Bausch Health in October

Bausch Health’s (BHC) net revenues declined from $4.3 billion in H1 2017 to $4.1 billion in H1 2018, reflecting an ~5.0% year-over-year decline.

Aug. 18 2020, Updated 6:32 a.m. ET

Revenue trends

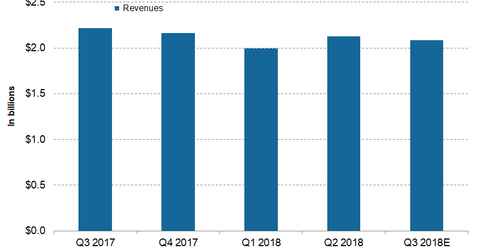

Bausch Health’s (BHC) net revenues declined from $4.3 billion in the first half of 2017 to $4.1 billion in the first half of this year, reflecting an ~5.0% YoY (year-over-year) decline. In the second quarter, Bausch Health generated net revenues of $2.1 billion compared to $2.2 billion in the second quarter of 2017.

Bausch Health (BHC) generated 78.0% of its net revenues from its Bausch + Lomb/International and Salix Pharmaceuticals divisions. These divisions reported combined 6.0% organic YoY growth. Wall Street analysts expect Bausch Health to generate revenues of $2.1 billion in the third quarter.

Among Bausch Health’s peers in the pharmaceuticals market, GlaxoSmithKline (GSK), Eli Lilly (LLY), and Teva Pharmaceutical (TEVA) generated second-quarter revenues of $9.9 billion, $6.3 billion, and $4.7 billion, respectively. The Invesco Dynamic Pharmaceuticals ETF (PJP) invests ~5.54% of its portfolio in Eli Lilly and ~2.88% in Bausch Health.

Expense trends

In the second quarter, Bausch Health (BHC) reported its cost of goods sold (excluding amortization and impairments of intangible assets) of $584.0 million. This figure reached $635.0 million in the second quarter of 2017.

Bausch Health reported R&D (research and development) and SG&A (selling, general, and administrative) expenses of $94.0 million and $642.0 million, respectively, in the second quarter.

Bausch Health’s expenditures on the amortization of intangible assets grew from $623.0 million in the second quarter of 2017 to $741.0 million in the second quarter. Bausch Health reported expenditures on amortization of intangible assets of $1.5 billion in the first half of this year, compared to $1.3 billion in the first half of 2017.

Bausch Health’s net operating expenses totaled $6.6 billion in the first half of this year compared to $4.0 billion in the first half of 2017. Wall Street analysts expect Bausch Health to report SG&A and R&D expenses of $627.0 million and $94.0 million, respectively, in the third quarter.