Bausch Health Companies Inc

Latest Bausch Health Companies Inc News and Updates

Eye Care Company Bausch + Lomb Seeks Major IPO in May

Global eye care company Bausch + Lomb is going public this week with likely the second-largest IPO in 2022. Here's what investors can expect.

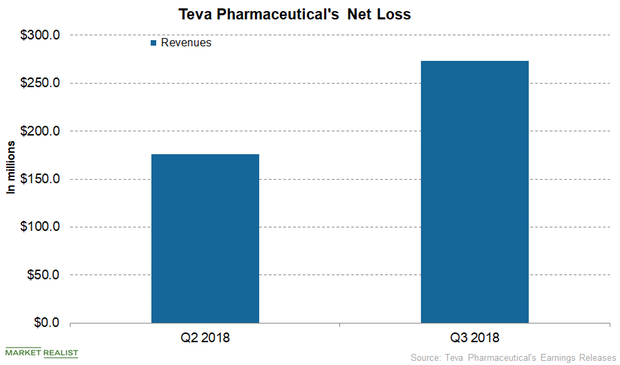

Teva Pharmaceutical: Earnings Trends and Recent Developments

Teva Pharmaceutical’s net income and diluted EPS in the first nine months of 2018 amounted to $541.0 million and $0.53, respectively.

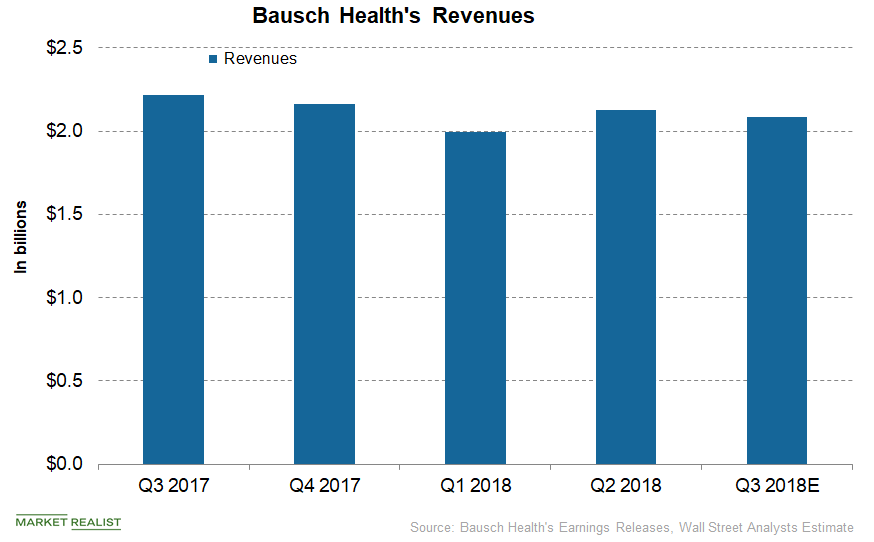

A Financial Overview of Bausch Health in October

Bausch Health’s (BHC) net revenues declined from $4.3 billion in H1 2017 to $4.1 billion in H1 2018, reflecting an ~5.0% year-over-year decline.

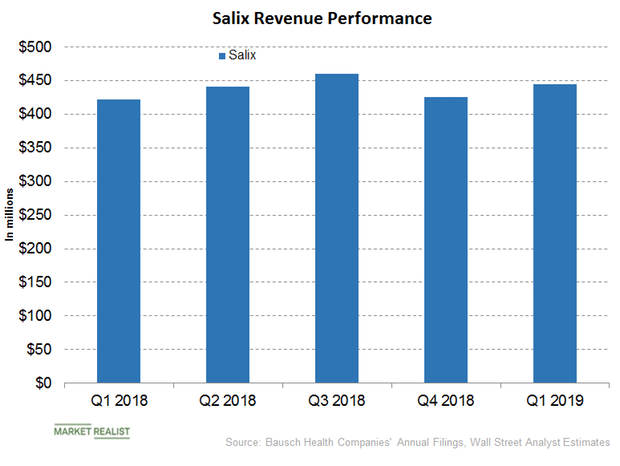

BHC’s Salix Segment: Xifaxan Drove Its Revenues in Q1

In the first quarter, Bausch Health Companies (BHC) reported revenues of $445 million for its Salix segment.