What Spark Therapeutics’ Valuation Trend Indicates

Spark Therapeutics’ (ONCE) operating expenses decreased from $78.48 million in Q2 2017 to $59.78 million in Q2 2018.

Dec. 4 2020, Updated 10:50 a.m. ET

Bottom line

Spark Therapeutics’ (ONCE) operating expenses decreased from $78.48 million in the second quarter of 2017 to $59.78 million in the second quarter of 2018. In the second quarter of 2018, it generated other income of $110 million.

That helped the company generate net income of $80.16 million in the second quarter of 2018 compared to a net loss of $74.36 million in Q2 2017. That translated to a net income per share of $2.07 in the second quarter of 2018. Its net loss per share was $2.40 in the second quarter of 2017.

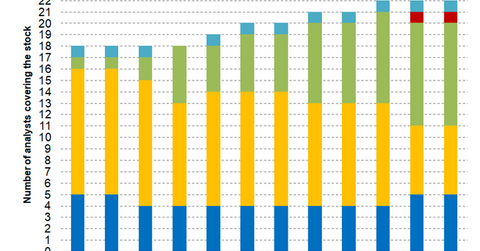

Analyst recommendations

Of the 22 analysts covering Spark Therapeutics in September, 11 of them have recommended a “buy” or higher, and nine have recommended a “hold.” Two analysts have given the stock a “sell” or lower rating. The mean rating for Spark stock is 2.41 with a target price of $69.67, implying an upside potential of 18% over its closing price of $59.04 on September 13.

Peer ratings

Its peers Esperion Therapeutics (ESPR), Intercept Pharmaceuticals (ICPT), and Axovant Sciences (AXON) have mean ratings of 2.27, 2.41, and 2.71, respectively, and target prices of $72.68, $123.07, and $4.70, respectively.

Valuation metrics

ONCE stock had a stellar rise from $50.60 on January 8 to $92.39 on July 9, which was also its highest point in 2018. It sharply corrected to its current $60 level in September. The stock has been trending downward after data for Spark’s SPK-8011 indicated that the results were not as positive as Valrox, a hemophilia A treatment manufactured by BioMarin (BMRN).

The enterprise value of Spark Therapeutics is $1.67 billion, and its enterprise-value-to-revenue ratio is 33.25x. Its price-to-book ratio is 3.79x.

Its current ratio, a metric of how effectively a company can meet its short-term obligations, is 18.50. In comparison, the current ratios of peers Esperion Therapeutics (ESPR), Intercept Pharmaceuticals (ICPT), and Axovant Sciences (AXON) are 5.40x, 6.50x, and 2.30x, respectively, indicating that Spark Therapeutics is in a better position to satisfy its short-term obligations than its peers.

In the next part, we’ll take a look at uniQure’s research pipeline.