Intercept Pharmaceuticals Inc

Latest Intercept Pharmaceuticals Inc News and Updates

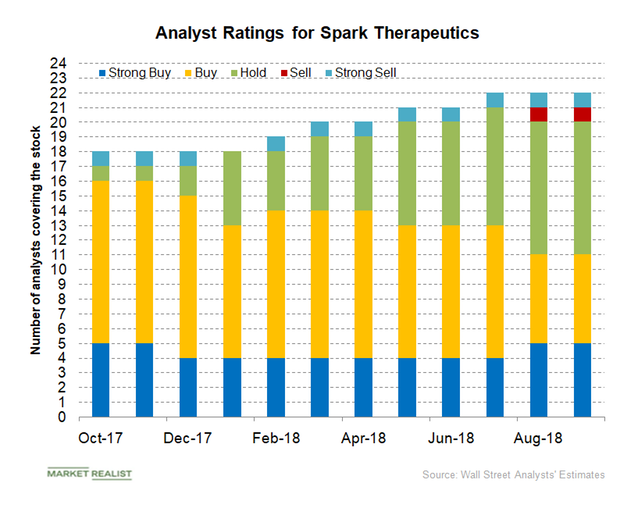

What Spark Therapeutics’ Valuation Trend Indicates

Spark Therapeutics’ (ONCE) operating expenses decreased from $78.48 million in Q2 2017 to $59.78 million in Q2 2018.Company & Industry Overviews What Explains the Columbia Select Large Cap Growth Fund’s Poor Showing?

The short-term performance of the Columbia Select Large Cap Growth Fund – Class A (ELGAX) is excellent, and the past six months have been great for the fund.