Stock Comparison: How Have COP, DVN, OXY, APC, and EOG Fared?

Stock performance In this article, we’ll discuss the year-to-date (YTD) stock performance of ConocoPhillips (COP), Devon Energy (DVN), Occidental Petroleum (OXY), Anadarko Petroleum (APC), and EOG Resources (EOG), which reported the highest revenue among upstream companies in fiscal 2017. Outliers and underperformers The above image shows that ConocoPhillips (COP) is the outlier among peers. YoY […]

Nov. 20 2020, Updated 3:30 p.m. ET

Stock performance

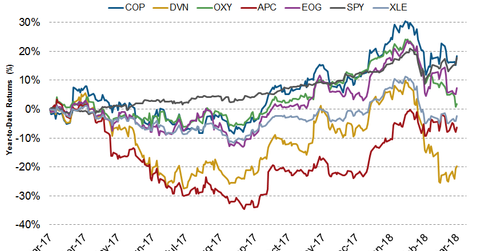

In this article, we’ll discuss the year-to-date (YTD) stock performance of ConocoPhillips (COP), Devon Energy (DVN), Occidental Petroleum (OXY), Anadarko Petroleum (APC), and EOG Resources (EOG), which reported the highest revenue among upstream companies in fiscal 2017.

Outliers and underperformers

The above image shows that ConocoPhillips (COP) is the outlier among peers. YoY (year-over-year), COP has risen ~18.5%.

EOG Resources (EOG) and Occidental Petroleum (OXY) have also seen stock price growth YoY, rising 7.4% and ~2%, respectively. In comparison, Anadarko Petroleum’s (APC) stock has fallen 6.3% YoY. Devon Energy (DVN) has underperformed peers, falling ~20% YoY. To know more about the upstream companies with the highest revenue and revenue growth, read The Top 5 Movers and Shakers of the Upstream Sector and Which Upstream Energy Companies Are Expected to Grow the Most?