Edwards Lifesciences Expands Portfolio with Harpoon Medical Acquisition

On December 6, 2017, Edwards Lifesciences (EW) announced the completion of its acquisition of Harpoon Medical for $100 million in cash on December 1, 2017.

Jan. 1 2018, Updated 9:05 a.m. ET

Harpoon Medical acquisition announcement

On December 6, 2017, Edwards Lifesciences (EW) announced the completion of its acquisition of Harpoon Medical for $100 million in cash on December 1, 2017. Up to $150 million of milestone-based payments are expected to be paid over the next ten years. The acquired business will be added to Edwards Lifesciences’ Surgical Heart Valve Therapy portfolio.

In 2015, Edwards Lifesciences had entered into an agreement with Harpoon Medical. EW made an upfront investment in Harpoon Medical for its R&D (research & development) efforts and had an option to acquire the company as key clinical trials in Europe ended.

Other recent acquisitions in the US medtech industry are Stryker’s (SYK) Entellus acquisition, Medtronic’s (MDT) Crospon acquisition, and the acquisition of Apama Medical by Boston Scientific (BSX).

Harpoon Medical

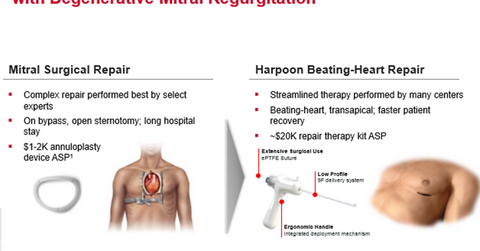

Harpoon Medical is a privately held company based in Baltimore, Maryland, which focuses on R&D (research and development). Its flagship product, Harpoon System, is a minimally invasive, image-guided surgical tool for beating-heart repair for DMR (degenerative mitral regurgitation). Harpoon System is designed to result in a reduced recovery period and shortened procedure duration.

Harpoon System has not yet received the CE Mark approval and is undergoing the regulatory approval process. The company expects to start commercial sales of the device in Europe by 1H18.

The clinical trials in the United States for FDA approval is expected to start in 2018, and the company expects to start selling the product in the United States in 2020 or 2021.

For diversified exposure to Edwards Lifesciences, investors can consider the Vanguard Mid-Cap Growth ETF (VOT), which has ~1.4% of its total holdings in EW stock.