Vanguard Mid-Cap Growth ETF

Latest Vanguard Mid-Cap Growth ETF News and Updates

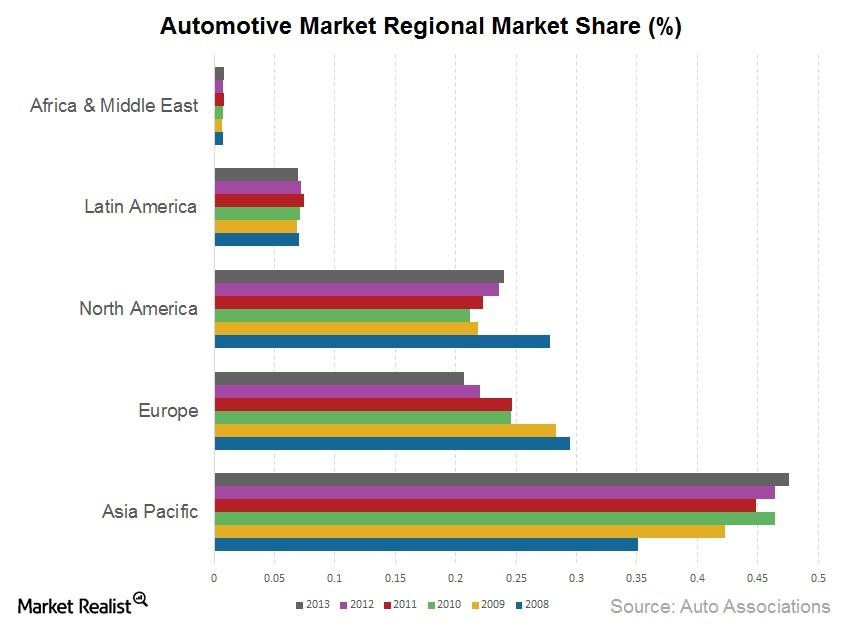

Consumer Why geography matters so much in the automotive industry

The U.S. market is dominated by truck sales, with trucks outselling cars at 51% of market share versus cars accounting for 49% of the market.

A must-know investor’s guide to Ford Motor Company

Ford Motor Company designs, builds, and sells automobiles worldwide. It is the second largest U.S.-based automobile manufacturer and the sixth largest globally, based on units sold.Consumer A must-know investor’s guide to Honda Motor Company

In this series, first, we’ll look at Honda’s strategy. Then, we’ll dig into the company’s revenue and earnings to see how Honda compares to other industry players.Consumer Why Tesla’s distribution model differs from competitors

Tesla states in the annual filing that it wants to maintain ownership of distributions and repairs to differentiate itself from the market, keeping greater control over local sales and services.Consumer Tesla’s financial statements show the company’s rapid growth

The bottom line on the income statement is that Tesla remains a start-up or newer business that’s not generating earnings from its sales.

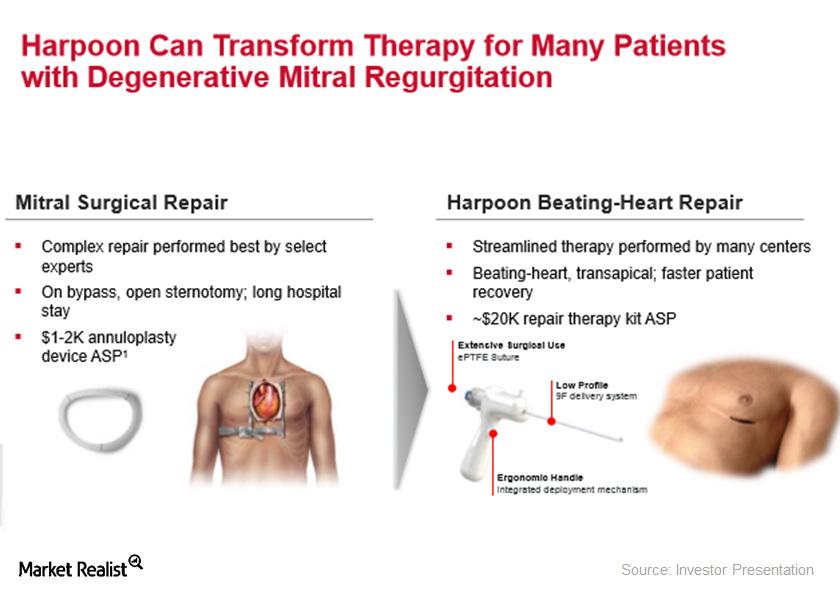

Edwards Lifesciences Expands Portfolio with Harpoon Medical Acquisition

On December 6, 2017, Edwards Lifesciences (EW) announced the completion of its acquisition of Harpoon Medical for $100 million in cash on December 1, 2017.

Edwards Lifesciences Focuses on Launch of SAPIEN 3 Ultra and CENTERA Valves

Edwards Lifesciences’ (EW) SAPIEN 3 Ultra system is a next-generation platform, with expandable Axela sheath technology and on-balloon delivery design.

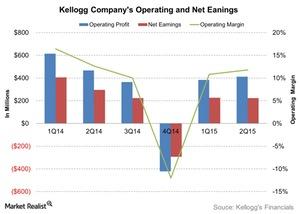

Kellogg’s Acquisitions and Their Benefits

The price of Kellogg’s acquisition of Diamond Foods is expected to reach over $1.5 billion, and Kellogg could offer the company between $35 and $40 per share.Consumer An investor’s guide to Toyota: Revenue and key drivers

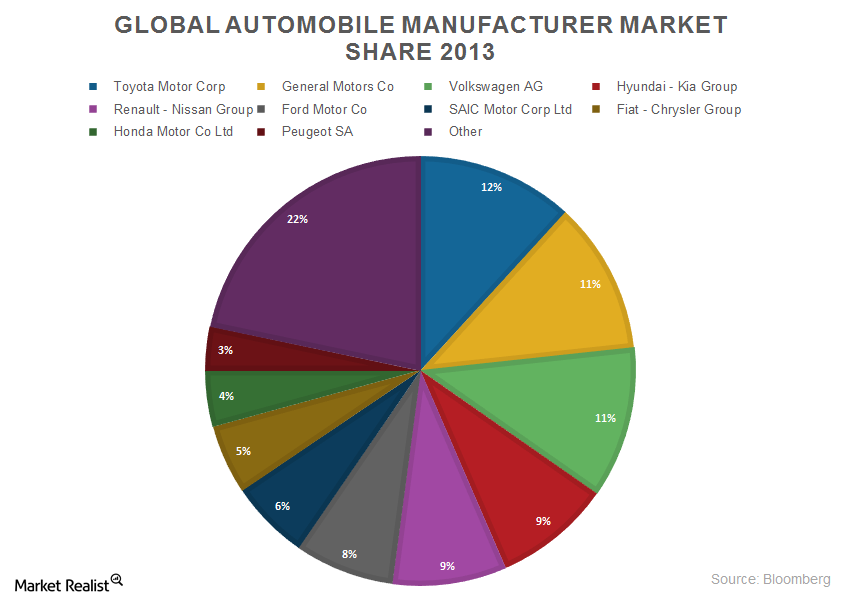

We’ll take a brief look at industry sales to assess Toyota Motor Company’s (TM) position in the global industry. First, we’ll look at industry sales, and second, we’ll assess Toyota’s ability to capture its share of the market.

An investor’s guide to Ford Motor Company: Revenue and key drivers

Ford is behind the industry trends with its 2013 units’ sales. Ford’s units in Latin America are roughly in line with industry sales at 8%.Consumer Must-know growth drivers for the global automobile industry

The global automobile market is impacted by global GDP, consumer confidence, employment, the availability of credit, the price of fuel, and consumer confidence.