What’s the Rationale for the Microsoft-LinkedIn Merger?

LinkedIn will be a standalone entity within Microsoft. This transaction is part of Microsoft’s plan to focus on cloud-based offerings. It wants to rely less on PCs.

June 14 2016, Updated 10:04 a.m. ET

LinkedIn fits with Microsoft’s emerging strategy

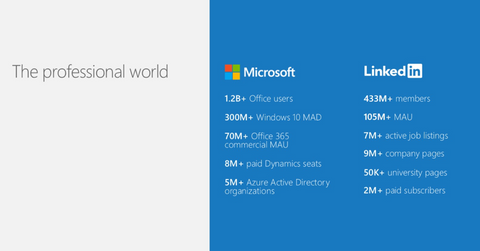

As we saw in the first part of the series, Microsoft (MSFT) is buying social networking giant LinkedIn (LNKD) in a $23.9 billion transaction including net cash on hand. LinkedIn will operate as a standalone entity within Microsoft. This transaction is part of Microsoft’s push to have more cloud-based offerings. It wants to rely less on PCs. Microsoft envisions using LinkedIn’s content with its digital assistant Cortana.

Management’s comments

“The LinkedIn team has grown a fantastic business centered on conncting the world’s professionals,” according to Microsoft’s CEO Satya Nadella. “Together we can accelerate the growth of LinkedIn, as well as Microsoft Office 365 and Dynamics as we seek to empower every person and organization on the planet.”

“Just as we have changed the way the world connects to opportunity, this relationship with Microsoft, and the combination of their cloud and LinkedIn’s network, now gives us a chance to also change the way the world works,” according to LinkedIn’s CEO Jeff Weiner. “For the last 13 years, we’ve been uniquely positioned to connect professionals to make them more productive and successful, and I’m looking forward to leading our team through the next chapter of our story.”

“Today is a re-founding moment for LinkedIn. I see incredible opportunity for our members and customers and look forward to supporting this new and combined business,” said Reid Hoffman—LinkedIn’s chairman of the board. “I fully support this transaction and the Board’s decision to pursue it, and will vote my shares in accordance with their recommendation on it.”

Merger arbitrage resources

Other important merger spreads include the deal between Cigna (CI) and Anthem (ANTM) and KLA-Tencor (KLAC) and Lam Research (LRCX). For a primer on risk arbitrage investing, read Merger Arbitrage Must-Knows: A Key Guide for Investors.

Investors who are interested in trading in the tech sector can look at the iShares Global Technology ETF (IXN).