Varian Medical Systems’ Growth Potential in Radiation Oncology

Varian Medical Systems’ next big technology innovation will be high-definition radiotherapy, which is an intelligent treatment delivery system that aims to achieve 100% radiation exposure for the tumor.

June 21 2016, Updated 9:06 a.m. ET

Varian Medical Systems’ market position

Varian Medical Systems (VAR) is a market leader in the radiation oncology device market. It continues to have a strong market share and excellent business growth. Further, the company has potential in emerging markets in this sector.

Global radiotherapy gaps and future demand are some of the growth drivers of VAR’s radiation oncology business. Other companies that manufacture devices in the field of radiation therapy include Accuray (ARAY), ViewRay, C R Bard (BCR), and Thermo Fisher Scientific (TMO). For diversified exposure to VAR, you can invest in the First Trust Health Care AlphaDEX Fund (FXH), which has ~0.4% of its total holdings in VAR.

Opportunities and growth potential

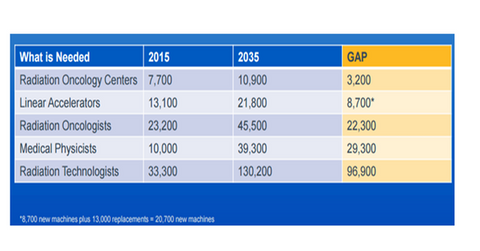

Approximately 50%–60% of cancer patients around the world need radiotherapy, whereas only 10% of patients in low-income countries have access to this technology. More than half of cancer cases reported come from high-income countries. Per Varian Medical Systems’ estimates, around 24 million new cancer cases are expected to be reported in 2030, as compared to around 14 million cases reported in 2012. Further, an estimated 3,200 additional radiation oncology treatment centers are required around the world to meet the needs of the potential patient population.

Varian Medical Systems aims to increase its radiation therapy capacity by 25% over the next ten years. Moreover, the company aims to train more medical professionals by 2025 in order the fill at least half the existing gap in the radiation therapy area.

Varian Medical Systems’ innovation initiatives

Varian Medical Systems’ next big technology innovation will be high-definition radiotherapy, which is an intelligent treatment delivery system that aims to achieve 100% radiation exposure for the tumor and no exposure for healthy tissue.

In the next part of this series, we’ll look at the key growth drivers of Varian Medical Systems.