Analysts Have Mixed Opinions about Ionis

Wall Street analysts estimate that Ionis’s (IONS) Q2 2018 revenues will rise ~30.0% to $135.5 million as compared to $104.2 million in Q2 2017.

Aug. 6 2018, Updated 9:40 a.m. ET

Wall Street analysts’ estimates

Wall Street analysts estimate that Ionis’s (IONS) Q2 2018 revenues will rise ~30.0% to $135.5 million as compared to $104.2 million in Q2 2017. Also, the company is expected to report a net adjusted loss of ~$24.9 million during Q2 2018.

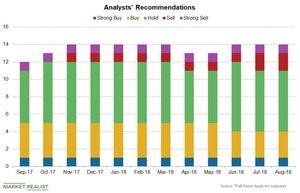

The above chart shows analyst recommendations for Ionis stock over the last 12 months.

Analysts’ ratings

Ionis’s stock price has decreased by nearly 14.5% over the last 12 months and decreased by ~14.3% in 2018 year-to-date. Analysts’ estimates show that the stock has a potential to return ~33.5% over the next 12 months. Wall Street analysts have a 12-month targeted price of $58.25 per share as compared to the last price of $43.62 per share as of August 3.

Analyst recommendations

As of August 3, 14 analysts are tracking Ionis. Of these 14 analysts, one analyst recommends a “strong buy,” three analysts recommend a “buy,” seven analysts recommend a “hold,” two analysts recommend a “sell,” and one analyst recommends a “strong sell” for Ionis. The changes in analysts’ estimates and recommendations are based on the changing trends in stock price and performance of the company. The consensus rating for Ionis stands at 2.93, which represents a “hold” for value investors.

Ionis’s valuation

As of August 3, Ionis trades at a forward price-to-earnings multiple of 78.7x as compared to the industry average of 14.1x. Also, the forward EV-to-EBITDA multiple for Ionis is 245.9x as compared to the industry average of ~11.7x.

The Invesco Dynamic Biotechnology and Genome ETF (PBE) holds 2.3% of its total investments in Ionis Pharmaceuticals (IONS), 3.2% in Sarepta Therapeutics (SRPT), 4.7% in Amgen (AMGN), and 4.9% in Gilead Sciences (GILD).