How Did Roche’s Diagnostics Division Perform?

Roche Holding (RHHBY) operates in the pharmaceuticals and diagnostics business units. The diagnostics unit comprises of professional, molecular, tissue diagnostics, and diabetes care.

June 25 2016, Updated 12:05 p.m. ET

Diagnostics division

Roche Holding (RHHBY) operates in the pharmaceuticals and diagnostics business units. The diagnostics unit comprises of professional, molecular, tissue diagnostics, and diabetes care. During the first quarter of 2016, the diagnostics unit’s sales stood at 2.6 billion swiss francs, which translates to 5% growth on an annual basis. The growth was fueled by a jump in Asia-Pacific and Latin America region sales. The segment’s sales in Japan fell by 3% in 1Q16.

For details on the diagnostics division, you can refer to Moderate Growth for Roche’s Diagnostics Unit.

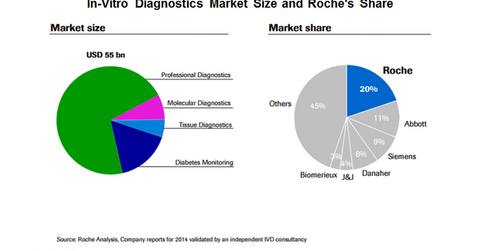

Roche is a market leader in the in-vitro diagnostics market. It holds a ~20% share in the $55 billion market. The market share is followed by Abbott Laboratories (ABT), Siemens (SIEGY), and Johnson & Johnson (JNJ).

Diagnostics division’s performance

Professional diagnostics sales in 1Q16 grew to 1.5 billion swiss francs, reflecting a 7% rise on a yearly basis. Its contribution to the total revenue in 1Q16 stood at 58%. During the period, the immunodiagnostics business grew by 12% while the clinical chemistry business rose by 6%. An 11% jump in the molecular business was driven by North America and Asia-Pacific sales growth.

Tissue diagnostics sales rose by 13% in 1Q16. The growth was driven by the company’s staining portfolio. Plus, the recently launched fully automated Ventana HE 600 system, which is used for hematoxylin and eosin tissue staining, supported the robust growth.

Diabetes care sales fell by 11%. The decline was driven by Medicare pricing pressure on the blood glucose monitoring portfolio in the US.

Industry-specific factors such as pricing pressure and patent expiries result in stock volatility. To avoid excessive company-specific risks, but also enjoy exposure to Roche, you can choose to invest in the Vanguard FTSE All-World Ex-US Index Fund (VEU). Roche accounts for 0.6% of VEU’s total holdings.