Why Did the WTI Cushing-WTI Midland Spread Drop?

The WTI Cushing-WTI Midland spread was at $4.12 per barrel on June 25—compared to $9.7 per barrel on June 18. The spread fell 58% on June 18–25.

Nov. 20 2020, Updated 2:17 p.m. ET

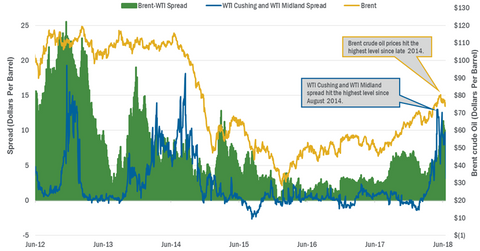

WTI Cushing-WTI Midland crude oil spread

WTI is the US benchmark for crude oil trading on NYMEX. WTI is priced at Cushing, Oklahoma—the point of delivery for futures contracts trading on NYMEX. WTI Midland is the price of oil at the Permian Basin. The WTI Cushing-WTI Midland spread was at $4.12 per barrel on June 25—compared to $9.7 per barrel on June 18. The spread fell 58% on June 18–25.

Why did the spread fall?

The WTI Cushing-WTI Midland spread hit $13 per barrel on May 7—the highest level since August 19, 2014. Rising Permian production and the insufficient pipeline capacity to move crude oil out caused the spread to increase. WTI Midland was trading ~$19 per barrel lower than Brent on May 7. Brent is the international crude oil benchmark.

Lower WTI Midland crude oil prices could have a negative impact on oil producers in the Permian Basin. Some of the oil and gas producers operating in Permian Basin are Pioneer Natural Resources (PXD), Apache (APA), Concho Resources (CXO), Cimarex Energy (XEC), and Diamondback Energy (FANG). These stocks fell 1.2%, 7.6%, 20%, 24%, and 5%, respectively, on May 7–June 25.

However, WTI Midland was trading ~$10.77 per barrel lower than Brent on June 25. A decline in the WTI Cushing-WTI Midland spread reduces Permian oil producers’ price disadvantage to their international peers.

Next, we’ll discuss OPEC’s meeting and spare production capacity.